Base Rate Rise Results in 60% of Remortgages Fixing for Five Years

According to the LMS Monthly Remortgage Snapshot, in the month of November 2021, almost two-thirds of homeowners who made the decision to remortgage did so on a five-year fixed rate. This is a direct result of the Bank of England’s decision to increase the base rate from an all-time low of 0.1% to 0.25%.

The main reason for remortgaging was to reduce costs, with 29% of property owners citing this as their primary motivation. By using a remortgage product, almost half of borrowers were able to reduce their monthly costs by an average of £198.19.

Around 33% of clients opted for a two-year fixed mortgage, while just 2% went for a ten-year fixed product, and another 2% chose tracker products.

Seventy-two per cent of buyers stated that they had chosen fixed-rate products in order to have more control over their monthly repayments. The state of the economy and an unsure future prompted 14% to find a fixed remortgage deal where they could be locked into a good deal, thereby giving some confidence in the future.

With the uncertainty of how the future will be affected by the ongoing COVID-19 issues and the government’s attempt to stabilise inflation, over eighty per cent of buyers expect that interest rates will continue to rise over the next year.

The predicted increased interest rate was fuelled by an eleven per cent rise in remortgage instructions during the month of November, ahead of the Bank of England’s increase in December.

The chief executive officer of LMS stated that remortgage activity was “largely fuelled” by an expected Bank of England base rate increase, which was already influencing banks and building societies to re-evaluate the prices of their mortgage products.

He added: “For borrowers coming to the end of their fixed term, this rise in rates prompted many to shop around to secure the best deal possible, rather than opting for a product transfer, as shown by the rise of 11 per cent in instructions month-on-month.”

“The high activity levels we witnessed in November are set to continue for the foreseeable future, spurred on by the high volume of early repayment charge (ERC) expires in December. This should keep the remortgage market buoyant as we head into the new year with a flood of new instructions.”

What Can We Buy to Let Landlords Expect in the Year 2022?

With a slowdown in house price growth, increasingly expensive mortgages, and more stringent regulations, what is in store for landlords for the year to come?

2021 saw a boom in house prices, increased rental costs, and record-breaking low-interest rates, creating an ideal environment for landlords across the UK. With the average house price rising by £23,902 over the last year, many landlords opted to sell their properties, resulting in large capital gains for them.

With demand exceeding supply for rental properties, rental costs have increased to rates not seen for the last thirteen years. Even with the increased tax levies, buy-to-let investors have had a very lucrative year. There are, however, some potential hurdles to cross in the year to come.

Changes to regulations require landlords to make the necessary adjustments in order to make their properties eco-friendly, and there is also the proposition of the scrapping of no-fault evictions.

House prices to stabilise

Since the onset of the pandemic, house prices have risen by an average of almost £34,000, with the highest growth since 2006 in the last three months. This has resulted in many landlords benefiting from the increase and making the decision to either sell, remortgage or release equity.

Sales director at buy-to-let lender Shawbrook Bank, Emma Cox, said: ‘Despite the hurdles caused by the pandemic, the market has stood firm, and house prices have continued to soar in price.

‘This has created attractive opportunities for investors, whose confidence in the market has grown over the last 12 months. Their buying activity and trends show that the market is likely to remain strong over the short term.’

It is largely dependent on whether demand exceeds supply and whether house prices will continue to rise in 2022.

Nathan Emerson, chief executive of Propertymark, said: ‘Whilst buyer demand is expected to follow usual seasonal trends and take a dip over the festive period, agents are not seeing any signs that demand will slow in 2022.’

He suggested that any more tightening of supplies would result in a dampening of the market later in 2022.

‘Many sellers wait to see something they like and will market on account of having found it.

‘Without an enticing catalogue of potential new homes, pipelines risk becoming starved heading into spring 2022.’

According to Halifax, house prices are only expected to rise a further 1% over the next 12 months; however, both Hamptons and Savills are predicting a rise of 3.5% on average.

Rent amounts are expected to rise

With intense competition for rental properties, buy to let investors have cashed in by increasing rental charges. The number of available rental properties over the past year was down 43% below the five-year average, massively increasing the competition amongst renters to secure the property.

2021 saw a typical rent increase of 4.6% year-on-year from September 2020, with an 8.6% rise outside the Greater London area, a level not seen for 13 years.

Policy director for the National Residential Landlords Association, Chris Norris, said: ‘2021 showed some signs of recovery for the private rented sector, which tends to be counter-cyclical in nature, with economic uncertainty leading more people to rent rather than commit to large purchases.

‘Demand for rental accommodation increased across the UK, with some early indications that tenants are also returning to London after many left during lockdown.’

Estate agents are warning of many landlords leaving the market, causing a shortfall. This is also partly the result of the upcoming changes in regulations for buy-to-let investors.

‘Looking into the private rental sector, rental income is poised to remain strong as demand holds steady,’ commented Emerson.

The continued fight against COVID-19 will also have an impact on the future of the rental market.

‘The fate of rental markets in the next 12 months will rest upon the COVID-19 pandemic,’ Emerson adds.

‘Heading into winter, there is an anxiety about the Omicron variant with the UK Government moving to Plan B measures.

‘This could push a new wave of movers as people look to change their surroundings, or we may see more wanting to stay put until life feels more certain.’

Stamp duty surcharge

Although the 3% stamp duty surcharge was still required to be paid by buy-to-let investors, landlords still made significant savings during the stamp duty holiday. According to a report by Hamptons, landlords who invested during the initial stamp duty tax relief saved, on average, the equivalent of around three months rent. The 3% surcharge will, now that the tax relief has come to an end, put off some buyers from investing in rental properties.

Emeritus professor of housing economics at the London School of Economics, Christine Whitehead, said: ‘Our work on taxation of landlords across Europe suggests that as a result of the changes in taxation since 2015, individual landlords in Britain are being increasingly disadvantaged when compared to corporate landlords and other investment types.’

Increase in mortgage rates

Tax blows dealt to landlords over the last few years have been somewhat softened by the competitive and cheap mortgages available to them. With the high expectation that interest rates are set to rise in 2022, it is thought that some potential landlords will opt not to invest as future profit margins will be lower.

The Bank of England has already increased the base rate from 0.1% to 0.25%, with more rises expected in the near future.

Chief capital officer at the mortgage lender, Swen Nicolaus, Molo, says: ‘Next year could bring many things to make landlords nervous. The very strong inflation we have seen in 2021 will be a priority for the Bank of England to tackle.

‘With the base rate forecast to rise and mortgage rates potentially following it up, it will create challenges not only in higher mortgage payments for those not in fixed rates but also for affordability requirements for those looking to purchase or refinance.’

London renters returning to the capital

The pandemic led to many renters making the decision to move from London to the suburbs as priorities in the type of property in demand changed. This led to a panic amongst landlords in the capital, resulting in a drastic decrease in the cost of renting city property. Rentals had fallen by up to 12% by January 2021.

The market in London is steadily recovering, with many people returning.

Propertymark’s Emerson stated: ‘In the first half of 2021, there was a mass exodus from cities as tenants turned to rural and coastal areas in search of a more relaxed and spacious lifestyle.

‘In the second half of 2021, we have seen the return of students and some work forces back into cities; however, many returned to find landlords had sold and the availability of homes was far less than usual.’

Updated EPC regulations

With more and more regulations and loopholes for buyers to navigate, it is not surprising that they are somewhat put off investing. The EPC proposals will mean that stricter regulations will need to be complied with by a certain date.

Landlords currently need to achieve a minimum rating of E on their energy performance certificate and will be required to perform annual gas safety checks. This will increase to the required rating of C by 2025 in order to try and achieve the government’s net zero carbon emissions by 2050.

Rob Bence, co-founder and chief executive of landlord forum Property Hub, says, ‘I think the changes in EPC regulations will be a hot topic in 2022.

‘As it stands from 2025, all new lets, irrespective of the age or location of the property, will likely need to have a C rating.

‘This is due to be rolled out to existing tenancies in 2028, but there are murmurs that the government is planning to extend the deadline for new lets by one year to 2026.

‘Either way, transforming Britain’s rental stock to meet the government’s targets is a big challenge for landlords.’

Could a Green Mortgage Save You Money?

Jumping straight to the conclusion, the answer is yes: a green mortgage can be uniquely cost-effective. As can living in an energy-efficient home, where all possible efforts are made to minimise energy consumption.

Qualifying for a green mortgage means meeting certain eco-friendly criteria, either before buying the property or after moving in. Green mortgages are primarily issued for the purchase of energy-efficient homes, but incentives are also available for buyers who commit to improving the eco-friendliness of their properties within the first 12 months following their purchase.

The benefits of living in a green home

Along with preferential mortgage rates and lower overall borrowing costs, there are additional perks to living in a green home.

For example, energy consumption is significantly reduced in a green household, leading to lower energy bills. A green home will almost always be significantly cheaper to run, adding up to generous and continuous savings.

In addition, the market value of a green home is almost always higher than that of a comparable ‘brown’ home. This therefore means that most energy-efficient upgrades and improvements will almost always pay for themselves long-term.

It can also be far easier to obtain a mortgage for a green home than a conventional home, as lenders are increasingly showing preference to buyers setting their sights on energy-efficient properties.

How can I get a property to meet green mortgage criteria?

If your goal is to get your property up to scratch to meet official ‘green’ criteria, it can be done in a variety of ways. In fact, any improvements you make that help reduce your home’s overall energy consumption could help.

Examples of cost-effective yet highly efficient ways to boost energy efficiency include the following:

- Properly sealing windows and doors to eliminate drafts

- Upgrading to more energy-efficient lighting

- Insulating walls and attics or improving existing insulation

- Adding smart devices and controllers to reduce energy consumption

- Stepping up to better double or triple-glazed windows

- Central heating system upgrades

- Installation of renewable energy sources, like solar panels

On average, it is estimated that upgrading a property in the UK from an EPC rating of D to C would cost around £6,000. For a larger detached property, the cost increases to around £12,000.

But these are still the kinds of costs that could be augmented long-term by switching to a green mortgage. Or perhaps with the contribution they make to the market value of the property when it is put up for sale.

Independent broker support

There are numerous factors to consider and calculations to perform when establishing the cost-effectiveness of green home improvements. Examples of this include the size, specification, and value of the property in question, your outstanding mortgage balance, the specific renovations required, and your general financial circumstances.

This is where independent broker support can prove invaluable, enabling you to build a clearer picture of the options available. Making efforts to run a more energy-efficient home is always advisable and could prove more financially beneficial in some instances than others.

13% Mortgage Interest Payment Hike Forecast by 2023

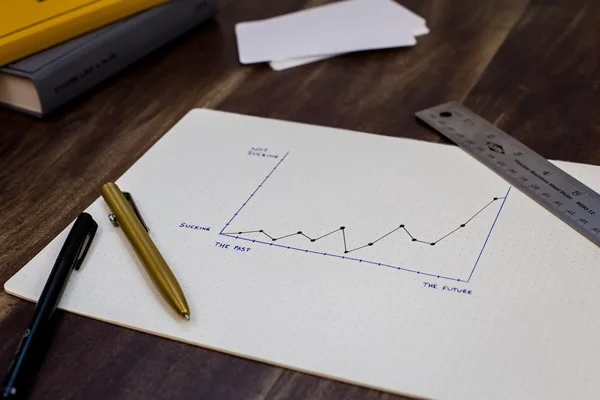

Startling data published by the government’s independent forecasting unit indicates that homeowners could be headed for the biggest mortgage interest hike seen since 2008.

By 2023, overall interest payable on a mortgage could increase by as much as 13%.

Members of the Liberal Democrat Party have warned that for homebuyers with an average mortgage of £211,000, the increase would constitute an additional £500 in interest payments per year. However, investment firm AJ Bell said that the costs could be even steeper for those with larger mortgages, who may be looking at £1,000 more every year in interest payments.

Interest rates remain at historic lows

For the time being, Bank of England base rates are being held at an all-time low of 0.1%. But both the Bank of England and the UK’s leading economists have warned that significant increases to base rates over the coming year are inevitable.

Specifically, the consensus now points to an initial increase of 0.25%, followed by a further three increases of the same amount to take base rates back to 1% by the end of next year.

In response, many major lenders are already beginning to withdraw their most competitive mortgage deals from their offerings. Brokers have reported major shifts in the mortgage lending market across the UK, with a wide variety of price shifts having taken place during the last few days alone.

The Office for Budget Responsibility data now points to significant year-on-year increases in mortgage interest payments, which could see homeowners facing an increase in costs next year of around 5.6%. This is then predicted to increase to around 13% in 2023, after which it will return to 5.4% in 2024.

The upcoming hike would be the biggest recorded since 2008, potentially leaving millions of homeowners out of pocket.

Higher costs for all mortgage payers

The figures have become a major political point of contention, with the potential costs for all mortgage payers having been highlighted by the Liberal Democrats.

Commenting on the predicted hikes, the party stated that the average mortgage payer at a variable rate of 3.6% would be looking at around £42 per month in additional interest payments, or £510 per year. Those with fixed-rate home loans at 2% would be liable for an additional £25 monthly payment, adding up to £300 per year.

“This ghastly forecast should send a shiver down the chancellor’s spine,” said Sir Ed Davey, Liberal Democrat leader.

Speaking on behalf of AJ Bell, their head of personal finance predicted even greater costs for mortgage payers over the coming years.

“Someone with £250,000 of borrowing who fixed earlier this year and renewed in 2023 would see £600 a year added to their mortgage costs, while someone with £450,000 of borrowing would see their costs hike by £1,068 a year,” she said.

34% of buy-to-let property investors intend to expand their portfolios in 2022

According to a report for Shawbrook Bank, a third of all landlords are planning to expand their portfolios by at least one property in the year to come. Despite the COVID-19 pandemic causing so much disruption to the economy, house prices have continued to rise and are maintaining record levels, which, in turn, is encouraging landlords to buy with the prospect of high rental yields.

Of the 34% of landlords, 14% said that they predicted that they would buy more properties than they initially intended, indicating strong confidence in the rental market for the future.

Although house prices remain at record levels, there is an expectation that property prices will rise even further in the next 12 months, with 67% of landlords saying they are confident that will happen and therefore prepared to take the risk of further investment.

Not only are landlords willing to add to their portfolios in terms of quantity, but they are also looking to expand into other locations. According to the research, 13% have plans to buy in areas they would otherwise not usually consider. Of those landlords, 30% are planning on investing in properties in rural areas and 36% in urban areas. The most popular area of the UK is proving to be the north of England for rental investment, with 23% of landlords stating they were looking to expand in this region.

Another change is the type of property that rental investors are considering, with alternative property development becoming increasingly popular. Many renters are looking for more outside space due to the lockdowns, resulting in semi-detached (34%) and terraced houses (31%) increasing in popularity as opposed to flats. Flats do, however, remain a favourable investment at 27%.

Sales director at Shawbrook Bank, Emma Cox, said: “The resilience of the UK property market is clear from our research. Despite the hurdles caused by the pandemic, the market has stood firm, and house prices have continued to soar. This has created attractive opportunities for investors and property developers, whose confidence in the market has grown over the last 12 months. Their buying activity and trends show that the market is likely to remain strong over the short term.

“Indeed, with 2021 announced as the “busiest year” for the housing market, according to Zoopla, despite recent falls in transactions, it’s clear that the market has fully rebounded from the lows of the pandemic. As supply continues to be low, it’s unlikely that we’ll see house price growth slow significantly, and as we move into January next year following the seasonal slowdown over Christmas, property investors will be seeking further opportunities to expand their portfolios.”