Bridging Sector Bouncing Back After £278m Fall in 2020

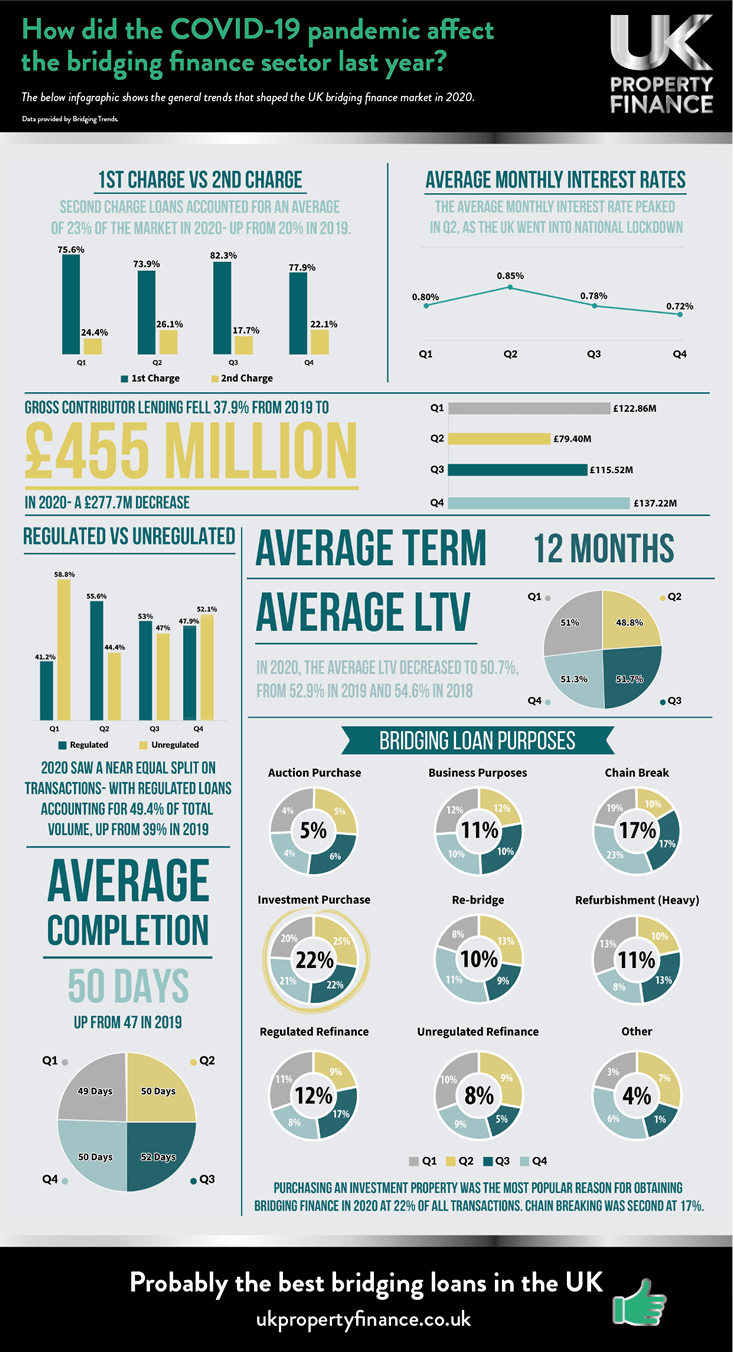

Almost every arm of the financial services sector in the UK was adversely affected by COVID-19 last year. The bridging finance segment was no exception, which, according to the latest figures from Bridging Trends, fell by £278 million compared to 2019.

(Click image for full-size version.)

In total, bridging loans valued at £455 million were provided by the lenders incorporated in the Bridging Trends annual survey, down from £732.7 million in 2019, or 38%.

Q1 saw total bridging finance transactions hit just under £113 million before experiencing a major fall to just £79.4 million in Q2. Transaction volumes increased significantly in Q3 to reach approximately £115.5 million and climbed to £137.2 million during the last three months of the year.

Regulated vs. unregulated bridging loans

Interestingly, 2020 bucked the trend of previous years by recording a near-identical split between unregulated and regulated bridging transactions. Regulated bridging loans accounted for 36% and 39% of transactions in 2018 and 2019, respectively; last year’s regulated market share was 49.4%.

Borrowers typically found themselves paying more for bridging finance during the first half of the year. According to Bridging Trends, average interest rates during the first three months of 2020 were 0.8% per month, increasing to 0.85% per month in the second quarter. This was followed by 0.87% in the third quarter and a fall to 0.72% in Q4.

The average LTV on bridging loans issued last year was down somewhat compared to previous years, which were recorded at 55.6% in 2018, 52.9% in 2019, and 50.7% in 2020.

An optimistic outlook

With interest rates hovering at all-time lows and activity levels once again returning to normal, the immediate outlook for the bridging sector has been called encouraging by most, with some suggesting that the current positive performance could extend far beyond the looming stamp duty holiday deadline.

“The impact of the pandemic on the bridging sector is shown clearly in Q4’s data, but it also alludes to the activity we are now experiencing, some of which, but not all, is related to the stamp duty holiday deadline.”

“It’s clear though that bridging finance is becoming better understood by the wider broker market (not just those in the specialist sector), and there is more confidence about the options it can provide customers, which should mean that 2021 could see a real watershed moment for this type of finance.”

Some have shown surprise that such a buoyant sector experienced such a dramatic decline in the first place, with comments such as:

“I am surprised that the fall in lending in 2020 was so great. The market has always ‘felt busy’ and we did not see such a big drop in volumes.”.

“Some big names in bridging closed their doors, and some are still not back as they were; however, most of the short-term lending market either carried on throughout or paused only temporarily as working practices were refined and made fit for purpose under the restrictions we faced.”

“The absence of some big names reduced supply, and coupled with restricting loan to value, this has had a marked impact on lending levels, which is also reflected in the fall in average loan to value over the year. However, as the trend in Q3 and Q4 indicated, we believe volumes will bounce back quite quickly, and with people re-entering the market, the data is reflecting the stiff competition lenders face for business in terms of lower interest rates.”