Thomas McAlpine Launches New Platform for Buying and Selling Land

One of the UK’s most innovative and experienced construction, land, and finance veterans has launched a dynamic new online platform for private and commercial land transactions. AddLand.com has the potential to revolutionise the process of finding, researching, buying, and selling land by simplifying all aspects of pinpointing high-potential investment opportunities across the UK.

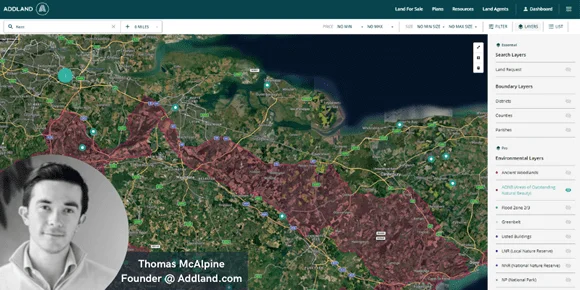

According to Thomas McAlpine, founder of AddLand.com, his company’s new platform is designed to help users quickly and confidently evaluate the potential of land purchase opportunities. AddLand.com extracts data in real-time from the Ordnance Survey, the Land Registry, and government sites, providing users with a cross-section snapshot of everything they need to know about the land listed for sale.

AddLand.com is designed to be simple enough for casual buyers and first-time housebuilders to find their perfect plots, though sophisticated enough for developers, commercial housebuilders, and land agents to locate viable sites for major development projects.

The platform has already attracted more than 50 of the UK’s biggest property firms, including Savills, Bidwell’s, and Land & New Homes Network.

A new-generation platform for buying and selling land

Commenting on the launch of the new platform, Thomas McAlpine spoke of Add Land’s potential to become the primary dashboard for all types of private and commercial land sales.

“We’re building a generational business with an emphasis on customer satisfaction,” he said.

“Our platform offers a single destination that brings land to life: an aggregation of existing industry subscriptions, an entire end-to-end back-office service, and all the research tools needed to undertake complete due diligence.”

“Digitalizing the whole process this way means we can create both time and financial efficiencies for our customers, making it easier to find, research, buy, or sell land.”

He also confirmed that there will be two subscription options available for those using the platform. The Add Land Essential package will be available free of charge, enabling users to research opportunities for land investments while receiving off-market land alerts, arranging inspections, exchanging messages with land agents, and submitting offers.

The paid Add Land Pro subscription targets more advanced commercial customers, providing access to a wealth of important information, including terrain levels, boundary details, ancient woodland, public rights of way, flood zones, and other environmental considerations.

Enhanced exposure for sellers

Along with simplifying the purchase process for buyers, AddLand.com also promises enhanced exposure for sellers listing their land for sale on the platform. Sellers will likewise benefit from the ability to manage all aspects of the sale process from a simple centralised dashboard as part of the paid Add Land Agent subscription package.

A selection of the paid subscription packages at AddLand.com is being offered free of charge until September this year, providing sellers and buyers with the opportunity to see what’s on offer before committing to a subscription.

“The feedback we have had so far has been hugely positive,” commented Thomas.

“We want to solve a fundamental issue for land agents, land buyers, and other land professionals.”

“I’m looking forward to welcoming more and more agents and land professionals in the coming months to Addison.”

Please visit AddLand.com for more information.