Probate Loans

Navigating the complex world of probate and inheritance can be stressful and confusing. Coupled with the emotional distress of losing a loved one, the legalities and financial aspects of gaining legal access to your inheritance can seem overwhelming. The need to settle any remaining debts or cover taxes before claiming legal ownership of assets can be particularly difficult. As a trusted and fully independent UK finance broker, we work hard to reduce these pressures with our tailored probate loan solutions. By adopting a sensitive, flexible, and personable approach to issues with probate, we provide a straightforward way to gain early access to inheritance or bridge gaps during the probate process.

Probate loans: key features

The probate loans we offer are tailored to meet your individual needs, with a strong focus on flexibility and affordability.

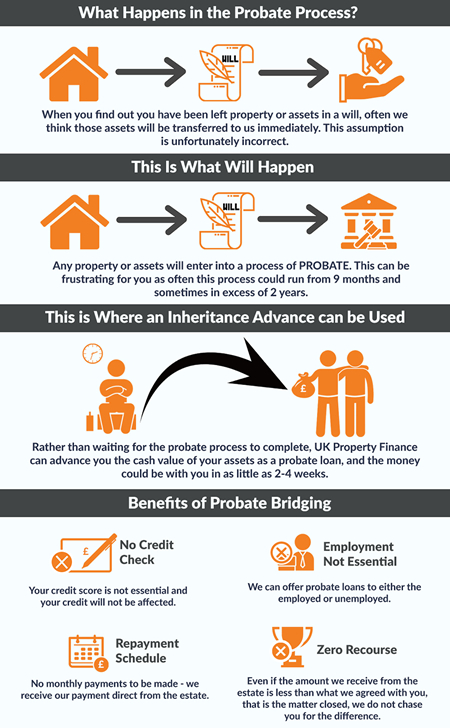

Probate Loan infographic

Key features include:

-

- £50K for Beneficiaries and £25k for Executors.

- Gain early access to up to 65% of your anticipated inheritance: Our probate loans allow you to access a significant portion of your expected inheritance.

- Can be used to pay inheritance tax (IHT): Probate loans can be an excellent solution for covering inheritance tax obligations.

- No monthly payments: With our probate loans, you won’t have to worry about monthly repayments. The loan amount, along with any accrued interest, is repaid in full once probate is complete and you receive your inheritance.

- The lowest interest rate: We offer competitive interest rates on our probate loans, ensuring that you receive the most affordable financing option available. Our goal is to provide you with financial support without burdening you with excessive interest charges.

- Funds can be used for any purpose. Whether you need to cover legal fees, settle outstanding debts, or make necessary repairs to the inherited property, our probate loans give you the freedom to allocate the funds as needed.

Typical Probate Loan Features Summary

| Feature | Explanation |

|---|---|

| Loan to value (LTV) | Based on estate and clients share – 50% before probate |

| Loan term | 6 months, rolling over |

| Loan amount | £50K for Beneficiaries – £25k for Executors |

| Interest options | Rolled-up |

| Probate loan rates | From 1.67% |

| Decision | No DIP – solicitor appointed required prior |

| Completion | 5 days to 3 weeks |

| Early repayment fees | None |

| Exit strategy | Repaid via estate distribution, refinance or sale of property. |

At UK Property Finance, we recognise the urgency and sensitivity surrounding probate matters. We will therefore do what it takes to prioritise your case and the loan arrangement process, enabling you to handle legal fees and inheritance tax obligations efficiently. Our experienced team is here to support you every step of the way, ensuring a smooth and seamless experience. Call or email UK Property Finance anytime for more information on our probate loans or to discuss any of our short-term lending solutions in more detail.

Bridging Loans for Probate

An alternative to a specialist probate loan, bridging loans can serve as an excellent solution to cover inheritance tax bills or gain advance access to your inheritance. Bridging finance provides short-term funding at rates as low as 0.55% per month, allowing you to bridge financial gaps until probate is complete and the inheritance is received. With bridging finance, you can borrow against the equity you have built up in your current home or any other residential or commercial property. These funds can then be used for any legal purpose (including covering IHT), enabling you to gain access to your estate without delay. The full loan balance is then repaid a few months later, either through the sale of the property used as security for the loan or with the capital you inherit as part of your allocated estate. Don’t let financial constraints slow down or stall the probate process. Call UK Property Finance today or email us with details of your requirements, and we will get back to you as promptly as possible.