Is Being a Property Developer Hard?

Beginning the process of property development may be both exciting and scary. From spotting attractive prospects to negotiating complicated financial environments, property development needs perseverance, insight, and strategic preparation. Is it difficult to be a property developer? is an often-asked question. Let’s look at the complexities of property development and how to handle its problems successfully.

Understanding the challenges

Property development encompasses a myriad of challenges that can test even the most seasoned developers. These challenges include:

- Financial Constraints: Securing adequate funding is often cited as one of the primary challenges in property development. Traditional lending avenues may not always be accessible or conducive to the needs of developers, particularly when dealing with large-scale projects.

- Market Volatility: Fluctuations in the real estate market can significantly impact the profitability and viability of development projects. Keeping abreast of market trends and anticipating shifts is crucial for mitigating risks.

- Regulatory Hurdles: Navigating through regulatory frameworks and obtaining necessary permits and approvals can be a time-consuming and bureaucratic process, adding layers of complexity to development projects.

The role of development finance services

In the realm of property development, access to tailored financial solutions is indispensable. This is where services like ours come into play. As a leading provider of development finance services in the UK, we offer a comprehensive suite of financial products designed to address the unique needs of developers.

Key features of our services:

- Tailored Financing Solutions: From bridging loans to development finance, we provide bespoke financial solutions tailored to the requirements of each project.

- Competitive Rates: With competitive interest rates and flexible repayment terms, developers can leverage financing options that align with their financial objectives.

- Streamlined Application Process: The platform streamlines the application and approval process, expediting funding to facilitate timely project execution.

- Expert Guidance: With a team of seasoned financial experts, ukpropertyfinance.co.uk offers personalised guidance and support throughout the financing journey.

Empowering developers with technology: the development finance calculator

In addition to accessing specialised financial services, developers can leverage technological tools to streamline their decision-making processes. A development finance calculator, such as the one offered by ukpropertyfinance.co.uk, can be a valuable asset in assessing the financial feasibility of development projects.

How a development finance calculator can help:

- Instant Assessment: By inputting key project parameters such as loan amount, interest rate, and repayment term, developers can obtain instant insights into the financial implications of their projects.

- Scenario Analysis: Developers can conduct scenario analysis by adjusting variables to assess the impact on loan affordability and project profitability, enabling informed decision-making.

- Risk Mitigation: Identifying potential financial risks early in the development process allows developers to implement risk mitigation strategies and optimise project outcomes.

In conclusion

While the journey of property development is undoubtedly challenging, it is also rife with opportunities for innovation, growth, and success. By harnessing the expertise of reputable development finance services like the ones we offer and leveraging tools such as the development finance calculator, developers can navigate the complexities of property development with confidence and strategic acumen. Ultimately, success in property development is not merely about overcoming challenges but about embracing them as catalysts for transformation and achievement.

How Using a Finance Broker Can Save You Time and Money

One of the oldest but most universal rules in the book when it comes to good business is to always, where possible, cut out the middleman. By going directly to the source, you will usually find that whatever it is you need, you can save money on it or at least get a better deal.

Hence, there is a tendency among businesses and entrepreneurs to take their requirements directly to lenders.

All of which seems logical on the surface but can, in fact, prove quite a costly mistake. Where independent finance brokers are concerned, what you’re looking at is one of the few true exceptions to the above rule on cutting out the middleman.

When you apply for business finance of any kind using a finance broker, you could save yourself a lot of time, effort, and even money.

How can the involvement of a third party ever prove genuinely cost-effective? By bringing you and your business the following benefits, among others:

They know the available products inside out

Unless you have been working in the financial service sector for decades, you cannot expect to know and understand the full scope of funding solutions available. Consequently, you may not know which of the products up for grabs is right for you.

By contrast, brokers who live and breathe commercial finance can help pair your requirements with the exact product you need. Often created from scratch as a bespoke solution, which you may not have realised was a viable option.

They can access exclusive deals and discounts

An experienced broker will work with an extensive panel of approved lenders, many of whom may not offer their services directly to clients. It is not uncommon for specialist service providers to issue finance exclusively via broker introductions, which means that working with a broker is the only way to access their products.

This is something that can pave the way for exclusive deals and discounts, the likes of which would not otherwise be accessible. A broker can compare and contrast offers from the largest possible network of lenders, ultimately translating to a better deal for you.

They can provide 100% objective information

The beauty of working with an independent broker lies in the fact that you also gain access to 100% objective and impartial advice. When you take your business directly to a lender, you cannot expect them to be completely honest. Even if they know you would be far better off elsewhere, they will attempt to win you over with their sales pitch.

With an independent broker, the information you receive is free of bias. They have no direct ties or affiliations with any specific brand, enabling them to provide objective advice you can count on.

They can negotiate on your behalf

Hiring a finance broker grants you access to their advanced negotiation skills. Your broker will take charge of negotiating on your behalf to ensure you get the best possible deal. This is something they do as a profession, putting them in a privileged position to support your business.

From interest rates to borrowing costs to terms and conditions, your broker will ensure all aspects of the agreement reached are amicable and affordable.

They won’t charge you a penny for the privilege

If all this wasn’t enough, the fact that all good finance brokers offer their support 100% free of charge means you really have nothing to lose. There is nothing to pay at any time, nor are you under any obligation to follow their advice.

Effectively, working with an independent broker combines the benefits of speaking to an experienced financial advisor with those of hiring a skilled negotiator. All without having to pay a penny for the privilege, irrespective of whether you go ahead or walk away.

Cash Buyers Catching the Eye of Home Sellers

Exactly what the next few years have in store for house prices remains to be seen. But what seems like a foregone conclusion in the eyes of most market watchers is a fairly significant fall in average house prices.

Savills recently predicted a 10% drop in 2023, while Knight Frank has forecast a 10% fall over the next two years. Elsewhere, Credit Suisse and Capital Economics have both projected a fall of between 10% and 15% within the next 12 months.

The consensus, therefore, appears to point to a fairly turbulent year to come for home sellers, at least for those looking to get the best possible prices for their properties. Average house prices are unlikely to get any higher than they are right now, seemingly making now the time to sell before any further declines creep into the mix.

Not only is this exactly what many are doing, but it is becoming commonplace for home sellers to set their sights primarily (if not exclusively) on cash buyers.

Chain-free sales

To hang around and wait for a potential 10% drop in property prices could prove catastrophic for anyone pursuing maximum capital gains. As a result, more home sellers than ever before are demonstrating enthusiasm (if not desperation) where selling their properties quickly is concerned.

A growing contingency of UK sellers is accepting inquiries and offers only from chain-free buyers, who can purchase their homes outright for cash.

The results of a recent survey conducted by mortgage broker MPowered found that as many as two-thirds of UK home sellers are only interested in offers from chain-free buyers. In addition, almost 30% said that they would charge higher prices for their homes if they sold them to standard mortgage-reliant buyers.

What this adds up to is a property market where those who are able to purchase homes outright for cash have a major advantage over competing bidders. Not just in terms of beating them to the punch, but also in their access to exclusive deals and discounts on property prices.

Traditionally, it has been practically impossible for everyday homebuyers to access the benefits afforded exclusively to cash buyers, but as the market for bridging finance continues its expansion, more mainstream buyers than ever before are empowering themselves with cash-buyer capabilities.

Bridging finance for fast property purchases

Escaping property chains and funding fast home purchases has become the number-one use for bridging loans in the UK. With bridging finance, the funds needed to purchase a property for cash can be raised within a few working days. Bridging loans are short-term products issued over terms of 12 months or less and secured against assets of value (typically residential or commercial property).

As mortgage rates continue to head ever-skyward, average bridging loan rates remain close to historic lows. Current deals are averaging just under 0.5% per month, equating to an APR of around 5.6%. But as the vast majority of bridging loans are repaid within a few months, bridging finance can work out exponentially more cost-effectively than any comparable mortgage.

Bridging finance is therefore providing home buyers from all backgrounds with a welcome lifeline—one that enables them to compete with the market’s more established cash buyers. Rather than being denied access to a sizeable chunk of the property market (and paying over the odds), anyone who can qualify for bridging finance can access all the benefits of purchasing homes for cash.

For more information on any of the above or to discuss the potential benefits of bridging finance in more detail, call anytime for an obligation-free consultation.

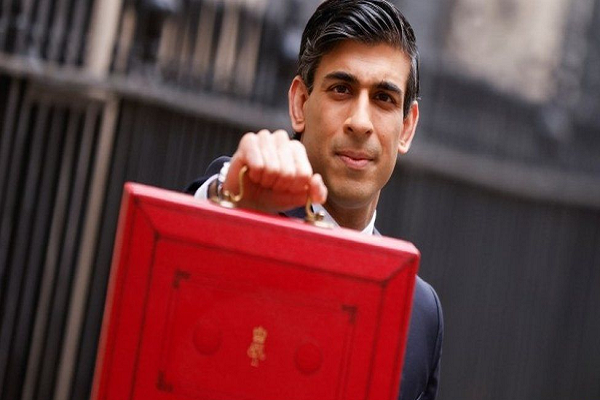

How the Budget is Likely to Affect the Housing Market

Things have been moving so fast as of late that it is difficult to believe it was only eight weeks ago that Kwasi Kwarteng devastated the UK economy with his catastrophic mini-budget. Since then, Jeremy Hunt has introduced a broad range of spending cuts and tax hikes with the aim of reversing at least some damage done by his predecessor and championing ‘stability, growth, and public services’.

According to the latest forecasts from the Office for Budget Responsibility, the UK is well and truly in recession, and inflation will likely level out at 9.1% at the end of this year.

As one of several measures brought into the housing market, the chancellor announced that the cuts to stamp duty, which Kwarteng announced would be permanent, would be phased out by March 2025. This basically means that a two-year time limit has been put on the cuts, after which they will be withdrawn.

Kwarteng had doubled the threshold at which stamp duty is paid to £250,000, while first-time buyers are also exempt from paying the first £425,000 of their purchase as long as the overall property price is below £625,000, rather than the previous £300,000.

Mr Hunt said that such an incentive will help support the housing market at a time when the economy needs it most, after which the gradual projected slowdown for the housing market over the next couple of years will render it less vital.

Figures from the OBR suggest that house prices could fall by as much as 9% between now and the third quarter of 2024, prompted largely by higher mortgage rates and a general lack of ability. The less competition there is for today’s excessively priced homes, the lower their prices will fall over time.

While a potential fall in average property prices of 9% seems steep, it is less so when put into perspective. Between the 12 months leading up to October this year, average property prices in the UK increased by a further 8.3%, according to data from Halifax.

Promising ‘to restore public finances and make the tax system fairer’, Mr Hunt also outlined a reduction in the previous tax-free allowance for capital gains tax (CGT), down from £12,3000 to £6,000 in 2023/24 and again to £3,000 in 2024/25. This is likely to have a significant impact on the general finances of second homeowners and landlords, who will be liable for larger payments upon selling residential properties.

But as the 28% CGT tax rate for higher-rate taxpayers has not been hiked, the outcome is not quite as bad as many had expected.

Elsewhere, the 45p rate tax threshold was reduced from £150,000 to £125,000, instantly moving a great many earners across the UK into the higher tax bracket. The chancellor declared that the inheritance tax nil-rate band would be frozen until the 2027–2028 fiscal year and that owners of electric vehicles would no longer be exempt from paying road taxes starting in 2025–2026.

What this means for the housing market

The combination of higher interest rates, higher taxes, and an elevated cost of living will undoubtedly have a knock-on effect on the housing market. People across the UK are already shelving their property purchases and investment plans indefinitely, and the trend is likely to continue for some time.

During this, a significant fall in average house prices is expected, but not so much as to reverse the extraordinary gains UK homes have collected over the past few years. Mortgage availability will likely increase as stability returns to the market, but most experts think the general picture will get worse before it gets better.

Council Home Construction in London Outpaces the Rest of the Country Combined

Newly published government data suggests that more council home construction projects commenced in London in 2021 than in the rest of the country combined. A total of 5,494 projects broke ground in the capital last year, compared to 4,325 spanning the rest of England as a whole.

Combined, this adds up to the most new council housing projects commenced in any year since 1979, when 9,128 projects broke ground.

Southwark was the London Borough that topped the table in terms of new council housing starts, with 895 new projects having commenced last year.

“There’s no quick fix to London’s housing crisis, but we’re taking significant steps in the right direction by backing a new renaissance in council homebuilding,” commented Mayor of London Sadiq Khan.

“In London today, we’re not just building more council homes; we’re building better homes too. The new generation of council homes are some of the best that have ever been built: modern, sustainable, and fit for the 21st century.”

“These new homes form a key part of building a better London for everyone: one that is greener, fairer, and more prosperous for all.”

“But the headwinds from recent economic chaos, combined with the effects of the pandemic, Brexit, the soaring cost of construction materials, and rising inflation, are hitting housebuilders hard and making housing delivery increasingly challenging.”

“That’s why I am urging ministers to provide additional funding so I can continue to deliver the good-quality and genuinely affordable homes that Londoners desperately need.”

The leader of Southwark Council, Kieron Williams, also praised the efforts being made to provide more affordable housing options in London.

“With the cost of living soaring, now more than ever, we need more council homes in our city,” he said.

“I’m delighted that we were able to start another 895 in Southwark last year, thanks to support from the Mayor, alongside our own council investment.”

“Achieving the most starts in London has been far from easy given the tidal wave of challenges facing the construction industry.”

“What worries me now is that those challenges are only getting harder as the national housing crisis deepens and construction costs spiral.”

“Having such a strong partnership between the mayor and councils is making a real difference, but we urgently need the government to get serious about solving the housing crisis too.”

Living cost crisis

The construction of thousands of new council homes in London may eventually bring some relief to those who continue to find themselves priced out of the market. In the meantime, the growing exodus of younger renters leaving London to find more affordable homes elsewhere is likely to continue.

Between April and March this year, the average rental price for a one-bedroom property in London equalled just over 46% of the average Londoner’s gross median pay. By contrast, renters across the rest of the country use around 26.4% of their gross median pay for rent.

According to Foxtons Estate Agents, one of the main drivers behind skyrocketing rent prices in London is explosive demand, coupled with minimal available inventory. They said that around 23,000 rental properties were listed on the market in September, meaning that an average of 29 people were competing for each property listed.

There are approximately 9% fewer properties available on the private rental market in London than at the same time last year, while demand has increased by as much as 20%.

Consequently, as many as 20% of younger people are planning on leaving London entirely, as they simply cannot afford to keep spending so much of their money on rent costs alone.

Return to normality triggers further affordability issues

Speaking on behalf of Hamptons, head of research Aneisha Beveridge said that the return to the new normal would most likely continue pushing average London rental prices higher.

“With COVID-19 being pushed further to the back of people’s minds, life in the capital is slowly returning to its new normal. Tenants are returning to the bright lights of the city, and this is driving rental growth to record highs,” she said.

“The rise of remote working means that fewer tenants are moving to the capital specifically for work. In fact, a growing number of tenants choosing to live in London are working fully remotely and could live nearly anywhere in the country. The footloose nature of many jobs today means that it will be culture and lifestyle rather than employment that become the capital’s biggest draw.”

Three Trends Set to Influence the Housing Market in 2023

Whether average property prices will fall by 10% or see further growth in 2023 remains to be seen. Depending on whom you ask, the next 12 months could see just about any eventuality become a reality for the UK housing market.

But what is safe to say is that when looking at the state of play today, there are several current trends set to influence the housing market in 2023.

Down valuations on the rise

The growing prevalence of ‘down valuation’ has been wreaking havoc on property transactions across the UK for much of this year. This is where surveyors place a value on a property that is less than its asking price, typically resulting in disputes between lenders and sellers while making it more difficult to close sales.

“As markets change, we can probably expect this difference in opinion to widen,” comments John Baguley at Countrywide Surveying Services.

As far back as the summer, many brokers reported encountering valuations that were as much as 20% lower than agreed property purchase prices, bringing major complications and conflicts into the negotiation process.

“There is a gulf between the reality of what buyers are willing to pay and what surveyors are willing to let go through,” said Jonathan Hopper of Garrington Property Finders.

This is one of many areas in which bridging finance could come into play as a potential solution, enabling buyers to sidestep the usual complications.

“In 2022, the most common use of bridging finance was to overcome a property chain break, surpassing its use to buy investment property,” said Stephen Clark

“We anticipate this will continue into 2023, as down valuations restrict homebuyers’ options, together with falling house prices, rising interest rates, and the cost of living.”

Auctions on the up

The popularity of auction property purchases has been gaining pace throughout the year as mainstream buyers and investors seek affordable homes and commercial properties via non-conventional channels.

Bridging finance provides buyers from all backgrounds with the opportunity to compete directly with cash buyers, enabling the completion of fast transactions while beating rival bidders to the punch.

“We have seen rising demand from auction buyers for bridging finance, enabling them to move at speed with flexible terms,” adds Stephen Clark

“Again, we expect this pattern to repeat itself through 2023 as more properties come up for auction.”

Total bridging loan volumes continue to hover around all-time highs, likely due to the fact that average monthly interest rates remain historically low.

“Some brokers are offering rates below 6% (annually), whereas the Halifax headline rate is above 6%. Bridging loans are extremely competitive at the moment,” commented Vic Jannels on behalf of the ASTL.

A quoted annual rate of 6% on a bridging loan would equate to 0.5% per month, leading up to a uniquely cost-effective facility when repaid promptly.

Putting the brakes on the chain breaks

Avoiding or repairing broken property chains has become the number-one use for bridging finance in the UK for the first time this year. For a broad range of reasons, homebuyers are turning to fast-access bridging loans to enable them to complete planned transactions in time-critical situations.

“Borrowers who have had mortgage products withdrawn with little or no notice or have lost their sale due to their buyers no longer fitting mortgage affordability criteria have turned to short-term funding solutions to ensure their purchase can go through as planned,” says bridging finance expert Stephen Watts.

Following several consecutive years at the top of the table, purchasing investment properties fell to second place in the rankings. Having accounted for 24% of all bridging loans issued in Q2, just 16% of transactions completed in Q3 were for investment property purchases.

UK House Prices Set to Fall in 2023

After more than two years of record gains, average UK house prices are now predicted to fall in 2023. But while this may buck the trend of the past couple of years, the likelihood of a major crash remains low.

Even in the face of growing economic uncertainty and an unprecedented living-cost crisis, demand for quality homes in desirable areas of the country remains strong.

October brought the first decline in average UK house prices in 28 months, according to data published by the Royal Institution of Chartered Surveyors. The same survey also found that house price expectations among market watchers and analysts also slumped for the first time in over a year.

Experts now believe that a decline of around 4.7% in average house prices will creep into the equation by the end of next year. This will mark the first annual drop recorded in over a decade and comes in stark contrast to the enormous annual house price gains collected over the past couple of years.

But as average house prices increased by almost 6.3% in 2022 alone, the declines forecast for next year are unlikely to have a huge impact on overall affordability.

“There is a rebalancing, but nothing like we saw after the global financial crisis. Supply is still relatively tight, so that is helping support prices,” said Chris Druce at estate agency Knight Frank.

Data from the Land Registry suggests that while average UK property prices fell by approximately 19% during the last global financial crisis, they have since doubled.

Supply issues continue to fuel higher prices.

Several major UK housebuilders have indicated that they have built fewer homes this year than originally planned, due largely to supply chain issues and escalating costs.

Taylor Wimpey Plc said that its housebuilding targets for 2022 would not be met, while Persimmon Plc has predicted 2023 land additions to be lower than in 2022. These and other factors will continue to affect the availability of housing across the UK, fuelling high prices.

Looking further ahead, 2024 is predicted to bring a slight increase in overall property prices: total annual gains of around 1%. After which, a further 3.5% increase has been forecast for 2025.

As polled by Reuters, experts believe that while a housing market crash cannot be ruled out of the equation, the more likely scenario is a correction. More than half of those polled said that the possibility of a crash remained high for the time being but that its impact would not be quite as severe as those experienced in the past.

“We see a one-year correction in 2023, with the economic performance and job numbers a little better than expected. 2023 will be a very difficult year, but life will feel semi-normal in 2024,” said Tony Williams at consultancy Building Value.

Even so, analysts have such wildly differing opinions on what will happen over the next 12 months that forecasting anything with even a slight degree of certainty is almost impossible. In London, experts believe that anything from a 12.5% drop to a 4.0% rise in average house prices could be recorded next year.

“Prices have continued to fall in London due to exacerbated affordability issues. New builds are also likely to plummet in London as build cost inflation and reduced development finance start to bite,” said Mark Farmer at Cast Consultancy.

Tenant Attempts to Sell the Home He Was Renting, Gets Two Years in Prison

In what Cambridgeshire Police have called a “truly brazen crime”, a private tenant has been jailed for attempting to sell the home he was renting in order to make off with the proceeds.

41-year-old Andrew Smith moved into the three-bedroom home in Cambridge in early 2020, only to list the property on the market just two weeks later. The listing was published via a non-existent online estate agent in the hope of tricking a desperate buyer into a quick sale.

And he almost succeeded, with one interested party coming dangerously close to handing over £400,000 for the property he didn’t even own. The price was agreed, and the sale was on its way to being finalised when an inspection by the buyer (accompanied by a drain surveyor) prompted suspicion.

After speaking to neighbours who said they were almost certain the house was being rented to its current occupant, he called the police. The subsequent investigation found that M upon. Smith had even rented furniture to stage the property for viewing by prospective buyers in order to sell it faster and for a higher price.

He was detained in Bedford and accused of engaging in money laundering and fraud by false representation. Having helped turn a quick profit at the expense of an unsuspecting buyer, Mr Smith was sentenced at Brighton Magistrates’ Court to two years and six months in prison.

“This is an almost unbelievable and truly brazen crime, which saw an innocent buyer almost part with more than £400,000 for a property that was never for sale in the first place,” said Detective Constable Dan Harper.

“The investigation has been long and detailed, and we have worked tirelessly to make sure justice has been served.”

A stark warning

Despite having been labelled an “almost unbelievable” crime, the prevalence of these types of incidents has been growing across the UK for some time. In particular, rapidly rising levels of “title fraud” are prompting homeowners in record numbers to register for property alerts with the Land Registry.

Incredibly, research suggests that as many as 97% of homeowners face the threat of their properties being sold illegally, without their consent or their knowledge.

From 2020 to 2021, the Land Registry recorded a 300% increase in the number of people registering for property alerts. According to new information released by Third fort based on a Freedom of Information Act request, more homeowners than ever before appear to be taking title fraud seriously.

But even now, a mere 515,000 property owners have so far registered for the service, which is provided 100% free of charge in England and Wales. This equates to just 2.5% of all property owners, suggesting that almost 98% face the very real risk of falling victim to title fraud.

As explained on Gov.co.uk:

“We will send you an email alert each time there is significant activity on the property you are monitoring, such as if a new mortgage is taken out against it.”

“The alert will tell you the type of activity (such as an application to change the register or a notification that an application may be due), who the applicant is, and the date and time it has been received.”

“Not all alert emails will mean fraudulent activity. If you don’t think the alert email is about any suspicious activity, you don’t need to do anything.”

“Signing up for Property Alert won’t automatically stop fraud from happening. You will need to decide if the activity on the property is potentially fraudulent and act quickly if so. The alert email will tell you who to contact.”