RICS Reports Post-Election UK Housing Market Improvement

It is safe to say that the Conservative Party’s landslide victory in the December general election represented a doomsday scenario for Remainers. For the first time, there is little to no doubt whatsoever that the United Kingdom will indeed leave the European Union at the end of January.

But far from dealing a hammer blow to the UK economy, the result of the general election has benefited some of the country’s most important markets. One of which is the housing sector, which, according to the Royal Institution of Chartered Surveyors (RICS), has experienced an “uplift” since the Conservatives gained a significant majority in the House of Commons.

An unexpected uptick

According to the RICS, sales expectations in London and the south-east of England have risen significantly for the first time in several months. Likewise, interest among new buyers is also on the increase across much of the UK, particularly in the North East of England and Wales.

The same, however, could not be said for Scotland and Northern Ireland, where sales continue to deteriorate on a monthly basis.

The latest figures released by the RICS should give some comfort to those looking to sell up or relocate over the coming months. Following years of relentless uncertainty, the housing market may once again be showing signs of life for the immediate future, at least.

“The signals from the latest RICS survey provide further evidence that the housing market is seeing some benefit from the greater clarity provided by the decisive election outcome,” said Simon Rubinsohn, RICS chief economist.

“Whether the improvement in sentiment can be sustained remains to be seen given that there is so much work to be done over the course of this year in determining the nature of the eventual Brexit deal.”

“However, the sales expectations indicators clearly point to the prospect of a more upbeat trend in transactions emerging, with potential purchasers being more comfortable following through on initial inquiries.”

House price increases are predicted

Elevated buyer interest is being motivated in many regions by significant falls in average house prices. Particularly in London, East Anglia, and the South East of England, home prices have experienced declines over recent months.

RCIS members, however, are now predicting widespread house price increases throughout the rest of 2020. Though once again, the market remains at the mercy of the outcome of Britain’s departure from the European Union at the end of January.

As it is not yet clear whether the Conservative Party will be able to negotiate an acceptable deal with the EU, uncertainty remains as to the future of the UK housing market and its long-term buoyancy.

Mortgage Prisoners Trapped in High Interest Contracts Fight Back

Thousands of UK borrowers ‘imprisoned’ in high-interest mortgages due to the nationalisation of their lenders are mounting a fight back against those responsible. As many as 150,000 homeowners have found themselves locked into high-interest loans, with no option of switching to a cheaper deal.

A group lawsuit is now being filed by the UK Mortgage Prisoner Action Group, with some of its members looking to claim tens of thousands of pounds in excess interest repayments. While the Treasury has insisted on its commitment to “removing barriers” to provide access to cheaper deals, those affected by the scandal have labelled the issue “a is grace.”

Unacceptable interest rates

The lawsuit filed by the UK Mortgage Prisoner Action Group comes in the wake of thousands of mortgages taken out in the late 2000s being privatised following the collapse of Bradford & Bingley and Northern Rock. Some of those affected have reported paying an APR in excess of 5% on their mortgages for at least 12 years, with no option to switch to a better deal. Work out the costs of a mortgage using our UK mortgage calculator.

This amounts to more than twice the interest being charged on equivalent mortgages by several major lenders during this time. One member of the group who spoke to the BBC stated that his mortgage interest rate has been locked at around 7%, resulting in tens of thousands of pounds in additional interest payments.

Like many, his mortgage was taken over by Northern Rock Asset Management (owned by UK Asset Resolution) following the downfall of Northern Rock. As his debt no longer exists as a mortgage in the traditional sense, the option of switching to a better deal with a new lender is not currently available.

Properties repossessed

The fightback against those responsible is being fronted by Damon Parker, partner at Harcus Parker Solicitors. Speaking with the BBC on Wednesday’s Victoria Derbyshire programme, Mr. Parker said that it is the obligation of those who now manage the collapsed banks’ debts to offer their customers a competitive deal.

“We say that our clients have been unfairly treated because they’re paying too much… at a time when every other mortgage customer is paying unprecedented low rates,” he said.

“It’s not fair to charge people just because they are collateral damage caught up in a nationalisation. Some people have gotten into terrible financial situations. Some people have been repossessed.”

A joint effort by the Treasury and the Financial Conduct Authority is said to be underway to help those affected access more affordable deals. However, it will ultimately be up to the banks and building societies themselves to agree to take over their mortgage debts.

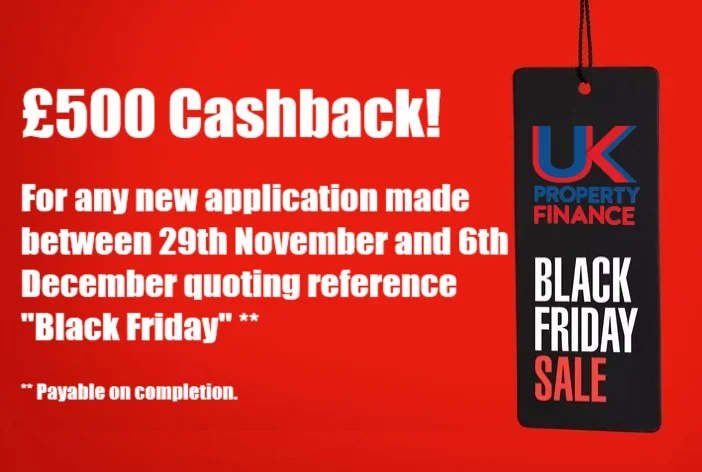

Introducing our best Black Friday deal ever!

UK Property Finance offers our best Black Friday deal ever!

At UK Property Finance, we are offering our customers £500 cashback for all new applications submitted between November 29 and December 6.

Please quote “Black Friday” to our advisors when discussing any new inquiries.

Enquire now to ensure you don’t miss out on earning £500 cashback.

Right to Buy: Four Misconceptions Clarified

Buying a home in the United Kingdom has never been more expensive. Affordable finance options are readily available, but the average UK property price has skyrocketed over the past 20 years.

Thousands of council tenants across England, however, are finding themselves able to potentially capitalise on a highly profitable opportunity. Those who qualify under the Right to Buy scheme may be able to purchase their properties for as much as £82,800 (increasing to £110,500) less than their official market value.

These kinds of enormous discounts have made property ownership more affordable for buyers than ever before. Nevertheless, there are some council tenants who continue to be daunted by the prospect of purchasing their home, even under the Right to Buy scheme. They believe it to be risky and complex, but the process for the buyer is actually quite straightforward and similar to any property purchase.

The four common misconceptions that stand in the way of prospective council property buyers are:

Misconception 1: “It’s too complicated!”

From the buyer’s point of view, it’s actually very similar to any property purchase. All that is needed is to establish your eligibility and then formally indicate your intention to purchase the property.

If you’ve lived in a council house for more than three years and you intend to purchase the house as your primary or only residence, it’s highly likely that you will qualify for a discount. If you’re happy with the purchase price after the discount is applied, then the process is the same as that of any other property purchase and, in fact, in some ways, more straightforward as the seller is less likely to pull out of the sale.

Misconception 2: “Right to buy is only for first-time buyers”

The truth is that there are few restrictions within the Right to Buy scheme in terms of previous homeownership. Again, just as long as you intend to use the property as your primary or only residence, it’s irrelevant how many homes you’ve owned in the past. The Right to Buy scheme is open to all qualifying council tenants across the board. Eligibility is measured by the length of the tenancy, the nature of the property, and so on. As such, you do not have to be a first-time buyer to qualify for a sizeable discount under the Right to Buy scheme in England.

Misconception 3: “The right to buy is only for low-income households.”

It’s surprising how many people think they would not be eligible for a Right to Buy discount on the basis of their earnings. While various schemes and incentives have been introduced over the years for low-income households, Right to Buy isn’t one of them. It’s worth remembering that some council homes in more prestigious locations across England have exceptionally high values. In this case, even a substantial discount wouldn’t eliminate the need for a large mortgage. Your income level will only affect your eligibility for the mortgage to purchase your home, not your eligibility for a discount.

Misconception 4: “I won’t be allowed to sell or let my property in the future.”

Some purchasers have naturally turned to the right to buy as a way to make money. Contrary to popular belief, those who qualify for Right to Buy discounts are perfectly entitled to sell or let their properties go from the moment they take ownership of them; however, if you sell your home during the first 5 years of purchase, you will be expected to repay some or all of the discount that you were granted.

If you are interested in the Right to Buy scheme or have any questions regarding secured loans or mortgages for home purchases, we would be delighted to hear from you. Book your obligation-free consultation with UK Property Finance today. Work out the costs of a mortgage using our UK mortgage calculator.

Escalating Issue with Unfinished Accommodation Hits Students Nationwide

Students across England are feeling neglected, let down, and angry. Having expected to move into comfortable and functional accommodation in time for the new term, hundreds are being told their student residences are not ready to be occupied.

The result of this is a growing number of students finding themselves stuck in hotels and other forms of temporary accommodation, away from the general student population. Often with no access to basic facilities, those affected are being forced to live on takeaways and use paid laundry services simply to keep their clothes clean.

According to student housing charity Unipod, at least 22 private student residences up and down the United Kingdom are facing severe delays. This equates to around a third of all the new blocks that were supposed to be ready in time for the new term.

Along with the expense, discomfort, and isolation being experienced by those affected, the National Union of Students has expressed concern about how the disruption may affect the quality of their educational experience.

The problem is particularly prolific in Portsmouth, where educators are calling for greater scrutiny over private student accommodation providers. The University of Portsmouth vice-chancellor, Graham Galbraith, stated that as the disputed developments are private, the university has no direct control over them.

“At the end of the day, those housing providers know that the universities will step in. So where does the responsibility for this lie? Because they seem to be able to walk away,” he said.

Mr Galbraith’s comments echo the sentiments of educators across the UK, who cannot understand the total lack of accountability for private student accommodation developers and building owners. He believes that as this entire arm of the industry is funded almost exclusively by maintenance loans, i.e., public money, it should be subject to the same scrutiny as any other form of public spending or investment.

He warned that, as things stand, there is no direct control whatsoever and that new student housing blocks can be built and opened with no interaction or dialogue with the university whatsoever. This is despite the fact that billions of pounds of taxpayers’ money fund these developments in the form of student maintenance loans.

A nationwide issue

Students in Portsmouth are far from alone in their plight, as the issue is spreading across the United Kingdom. In Bristol, for example, student housing delays have become so severe that some students are being temporarily housed in Wales.

According to Universities UK, the issue lies in the fact that its code of conduct is only applicable where university-owned accommodation is concerned. There is currently no specific code of conduct and no regulatory standards for private student developments, which are outside the control of the public sector.

It is therefore unclear who will make the first move or when, though educators agree that certain safeguards should be put in place for students.

Adding insult to injury, some students have been offered a mere £150 in compensation, which for many is far less than they are paying for a one-week stay at their temporary residence.

One of the private housing companies behind an unfinished development in Portsmouth has apologised unreservedly for the inconvenience, though it points the finger of blame squarely at its building contractor.

A spokesman for the housing company expressed its disappointment “to hear that the university does not consider that we have communicated effectively with them.”

“We believe that we have done everything possible to mitigate the impact for those affected in the time available.”

“We will continue to do all we can to get students into the building as an urgent priority.”

Could Buy to Let Investors Rescue Plymouth’s Empty Student Homes?

There’s a growing housing issue in several major UK cities, which, contrary to the usual trend, concerns supply outstripping demand. Regions with sizeable student populations are typically goldmines. For around 75% of the year, tens of thousands of properties are needed to accommodate learners. All of which adds up to a guaranteed income for building owners and landlords in normal circumstances.

Unfortunately, things appear to have taken a turn for the worse in Plymouth. This autumn, it’s estimated that up to 2,000 student bedrooms across the city could be vacant. all at a time when demand for quality student properties should be outstripping supply by a significant margin.

According to a local student letting expert, far too many flats have been built across the city at a time when student numbers are actually in a state of decline. The result of this is a crisis in the making, wherein any number of major developments risk standing vacant during peak student season.

This is a particularly severe issue for the city of Plymouth, which relies heavily on a sizeable year-round economic contribution from its student population.

“I’m seriously concerned,” said Henry Hutchins, chief executive of Clever Student Lets.

“I can see between 1,500 and 2,000 empty units in Plymouth.”

He also reported dealing with at least one landlord who now faces going out of business, which has been unheard of for student property owners over recent years.

The speed at which new student properties have been built across Plymouth has resulted in far more vacant inventory than the city needs. Over the past year alone, an additional 5,243 student bed spaces have appeared across Plymouth. many of which accommodate imposing skyscrapers and former commercial properties.

Far from accommodating a swelling student population, all this is happening at a time when student numbers in Plymouth are on the decline. According to official figures from the University of Plymouth, the city’s approximate student population has plummeted from 32,000 in 2010/11 to 21,000 in 2017/18.

Experts have also commented on the declining numbers of international students choosing to study in Plymouth.

Mr. Hutchins highlighted the economic impact of approximately 11,000 fewer students living and studying in the city.

“Students are spending £300 million a year in Plymouth, so if you take out 30 per cent fewer students, that’s about £90 million less being spent in the city centre,” he said.

“I’m worried about that spend and the effect it will have on retail and employment.”

“The whole market is under pressure. I’ve been stating this for two years and no one has taken notice, and now it is going to have a real effect in Plymouth.”

He and other experts are predicting a slow but gradual increase in student numbers over the years to come, but they can also see a number of student flats and buildings being repurposed into conventional flats.

“They might have to re-jig the market,” he said.

It’s therefore possible that the issue could play directly into the hands of the savvy buy-to-let investor. On one hand, it’s often true to say that purpose-built student flats aren’t of the same quality standard as more conventional city-centre flats. They also tend to be smaller and of a somewhat non-standard configuration. all of which could add up to significant redevelopment costs for investors.

At the same time, however, desperation and urgency on the part of vacant property owners could lead to significant price reductions. The money saved on the initial purpose of the property could therefore be used for renovations and/or repurposing before being let out at a profit.

There’s also talk of some vacant student inventory being acquired by social housing groups, though none have commented on the issue so far.

Housing Crisis: Spare a Thought for the Youngest In Society

The housing crisis in the United Kingdom means different things to different people. For some, skyrocketing property prices are playing directly into their hands and, indeed, their pockets. For others, it’s a case of accepting the stark reality that homeownership is unlikely at best.

Research suggests that approximately 90% of young people in Britain intend to own their own home at some point. Unfortunately, research from Santander suggests that only one in four young Britons (26%) will be on the property ladder by 2026.

This contrasts starkly with figures from 2006, at which time approximately half of young Britons (under the age of 34) owned their own home.

Of course, none of this will come as a real surprise to younger generations in the United Kingdom. The combination of astronomic property prices and stagnant wages has made the dream of homeownership an unlikely reality for most. Precisely why more than 70% of millennials believe that their chances of owning their own home are slim to none.

An escalating issue

With the state of the UK housing market as it is, fewer would-be first-time buyers than ever before are making concerted efforts to get on the property ladder. Research suggests that only 42% have anything put away to cover the deposit on a prospective property. Interestingly, of those who had earmarked savings for a deposit, men were found to have saved twice as much as women.

While the men polled who had deposit savings put away had an average of £11,600, the women polled had saved an average of £5,620. Across both gender groups, the average target amount for those saving towards a property purchase was £24,000.

Had they managed to hit this target, which the vast majority didn’t, they would still have fallen short of the required funds to buy a home. Today, taking out a mortgage on an average property in the United Kingdom means coming up with a deposit of £44,000. For most everyday earners, this is simply out of the question.

In 1996, approximately 65% of people on low to medium incomes (between £20,000 and £30,000) owned a home. By 2016, this had fallen to just 27%.

Today, it’s estimated that around 65% of homebuyers have incomes of more than £40,000—significantly higher than the national average. Salaries have been rising on average by a mere 18% over the past decade, failing to maintain pace with average house prices, which are all around 47% for the same period.

Speaking on behalf of Santander Mortgages, managing director Miguel Sard acknowledged the difficulty facing an entire generation of first-time buyers.

“It’s clear that while the aspiration to own a home is just as strong as in previous generations, it’s a dream that is looking increasingly out of reach,” he said.

“Without change, homeownership in the UK is at risk of becoming the preserve of only the wealthiest young buyers over the next decade. This report should be a wake-up call for industry and the government to think more creatively to keep the homeownership dream alive for the next generation of first-time buyers.”

With conventional purchase channels all but closed, more first-time buyers than ever before are turning to friends and family for help. In fact, the study from Santander suggests that almost 40% of all first-time buyers now rely on support from parents and grandparents to purchase their homes.

In the meantime, the number of British people taking on second homes as buy-to-let properties is reaching an all-time high, having doubled since 2001. As wealthier Brits continue to capitalise on sky-high property prices and accelerating rental yields, an entire generation risks being priced out of the market. All attempts by the government to address the issue (Help to Buy, lifetime ISAs, etc.) have so far been criticised as inadequate or simply not fit for purpose. Unless more drastic action is taken, the issue is only predicted to continue worsening over the years and decades to come.

Interest Only Mortgage: What Are My Options?

Interest-only mortgages were once popular among home buyers across the UK. Today, a growing number of major banks and lenders are rapidly phasing interest-only mortgages out of the picture. primarily due to a growing lack of interest among borrowers.

With an interest-only mortgage, the subsequent monthly repayments cover only the interest on the loan but not the capital. The advantage is that the average monthly repayments on an interest-only mortgage can be extremely low. However, you’re still liable to pay back the full amount you owe on your home at the end of the term in one lump sum.

For obvious reasons, this can result in issues for those who simply do not have the funds available to pay off their loans.

More often than not, borrowers taking out interest-only mortgages use savings systems like ISAs to amass the money they need over time. The flexibility of an interest-only mortgage can be great, but there are no guarantees that the borrower will have enough money available at the end of the loan term.

There are currently around 1.6 million outstanding interest-only mortgages in the UK, and repayment difficulties are surprisingly common. Work out the costs of a mortgage using our UK mortgage calculator.

Handling repayment difficulties

If you simply do not have enough money saved to pay off your mortgage at the end of the term, it’s important that you consider your available options at the earliest possible stage. The earlier you take action, the easier it becomes to avoid an outright disaster.

There are four basic options available in such circumstances, as outlined below:

Take out a new interest-only deal

If you are deemed eligible, you may be able to enter into a new interest-only mortgage. This will depend on the value of your property, your current financial position, and your age. It can be a challenging and potentially costly process, but it could also prevent your home from being repossessed. Speak to your lender or independent broker at the earliest possible stage.

Switch to a repayment deal

Again, depending on your personal circumstances and the value of your property, it may be possible to switch to a more conventional mortgage deal. Rather than paying off the money you owe in one lump sum, your lender may be willing to organise a more gradual repayment deal. This is one of the most popular options among struggling borrowers, as it provides the opportunity to maintain ownership of their property and repay their debts over several years. Interest rates and additional borrowing costs will apply.

Sell your home

Another viable option is to sell your home, repay the money you owe, and hold on to the rest of the proceeds yourself. This can be particularly useful if the value of your home now significantly exceeds its original purchase price. However, there’s every possibility that the value of your home will not cover the amount you owe. Again, it’s important to seek expert advice at the earliest possible stage if considering this option.

Take out an equity release plan

Last but not least, equity release plans provide homeowners with the opportunity to tap into the capital tied up in their homes. You release some or all of the value tied to your home, repay your interest-only mortgage debt, and make subsequent ‘rent’ payments to the new lender. Depending on the value of your home and how much of it you own at the time, you may be able to repay your interest-only mortgage and continue to live in the property rent-free. As equity release is by no means suitable for all homeowners, it’s important to seek independent financial advice before making your final decision.