What is The Meaning of Mortgage Finance?

In the UK, purchasing a home is often considered a significant milestone, representing stability, security, and a sense of accomplishment. However, for many aspiring homeowners, the path to homeownership is paved with financial considerations, particularly the complexities of mortgage finance.

Understanding Mortgage Finance: The Basics

Mortgage finance, the cornerstone of homeownership, involves borrowing money from a financial institution, such as a bank or building society, to purchase a property. The borrowed amount, known as the principal, is repaid over an extended period, typically 25 years, with interest accruing on the outstanding balance.

Types of Mortgages: Tailored to Individual Needs

The UK mortgage market offers a variety of mortgage types, catering to diverse financial situations and preferences:

- Fixed-rate mortgages: These mortgages provide the security of a fixed interest rate throughout the loan term, ensuring predictable monthly payments.

- Variable-rate mortgages (VRMs): VRMs offer lower initial interest rates but are subject to fluctuations based on market conditions.

- Tracker mortgages: Tracker mortgages closely follow a benchmark interest rate, such as the Bank of England base rate, with monthly payments adjusting accordingly.

- Offset mortgages: Offset mortgages allow linking a savings account to the mortgage, reducing the interest payable by offsetting the mortgage balance with the savings balance.

The Mortgage Process: A Step-by-Step Guide

Securing a mortgage involves a multi-step process, including:

- Credit check: Lenders assess your creditworthiness to determine your ability to repay the loan.

- Affordability assessment: Lenders evaluate your income and expenses to ensure you can comfortably afford mortgage repayments. This can be done using a mortgage calculator.

- Property valuation: A surveyor appraises the property to determine its market value and inform the loan amount.

- Mortgage offer: Upon approval, the lender provides a formal mortgage offer outlining the terms and conditions of the loan.

- Legal formalities: Solicitors handle legal aspects, including conveyancing and title checks, to ensure a smooth transaction.

- Completion: Upon finalising all formalities, the property is purchased, and the mortgage becomes active.

Mortgage Finance: Benefits and Considerations

Mortgage finance offers several advantages:

- Achieving homeownership aspirations: It enables individuals and families to purchase their dream homes.

- Leveraging equity: Over time, homeowners build equity in their properties, increasing their net worth.

- Tax benefits: Certain mortgage-related expenses may be eligible for tax deductions, reducing overall tax liabilities.

However, mortgage finance also presents potential challenges:

- Debt obligations: Mortgages represent significant financial commitments, requiring long-term monthly payments.

- Interest rate fluctuations: Interest rates can rise or fall, affecting mortgage affordability and repayments.

- Foreclosure risks: Defaulting on mortgage payments can lead to foreclosure, resulting in the loss of the property.

Seeking Professional Guidance: Navigating the Mortgage Journey

Given the complexities of mortgage finance, it is advisable to seek professional guidance from independent financial advisors or mortgage brokers. They can provide tailored advice, assist in comparing mortgage options, and help you make informed decisions aligned with your financial goals.

Conclusion: Unlocking the Door to Homeownership

Mortgage finance plays a pivotal role in enabling homeownership and fostering a sense of stability and belonging. By understanding the intricacies of mortgage finance, individuals can navigate the mortgage journey with greater confidence, making informed decisions that pave the way to achieving their homeownership aspirations.

Bridging Loans Explained: A Summarised FAQ

What are bridging loans?

As the name suggests, a bridging loan is a temporary solution for a short-term financial gap. Typically, issued over the course of no more than a few months, bridging finance effectively ‘bridges’ the gap between a purchase or investment and the procurement of funds by other means.

What can bridging loans be used for?

One of the most appealing aspects of bridging finance is the way in which it can be used for almost any legal purpose whatsoever. Even so, some of the most popular applications for bridging finance in the UK are as follows:

- Opting out of property chains or reversing chain break scenarios

- Purchasing properties at auction for less than their true value

- Beating competing bidders to the punch by purchasing properties for cash

- Buying ‘unable to mortgage’ properties to renovate and sell on

- Covering unexpected business costs and general outgoings

- Buying homes to be renovated and let out to tenants

- Just as long as you can provide your lender with proof of a viable exit strategy (how you plan to repay the loan), there are no limitations placed on how you can use the funds.

Bridging loans are not restricted solely to property use, but, as we’re writing a property blog, that’s what we’ll stick to here today.

How is interest calculated on a bridging loan?

Interest and overall borrowing costs on bridging finance vary from one facility to the next. Instead of a conventional APR, bridging loan interest rates are usually published as a monthly rate of interest (which can be as low as 0.5%).

This interest can be repaid monthly or rolled up into the final loan balance. Likewise, all associated borrowing costs (arrangement fees, transaction fees, completion fees, etc.) can be added to the final balance payable.

In the meantime, no monthly repayments are necessary, enabling the borrower to maintain total cash flow efficiency. The full balance is then repaid in a single lump-sum payment on an agreed-upon date.

What is the difference between open and closed bridging loans?

Open-bridging loans are those that are issued with no fixed repayment date. The borrower enjoys a greater degree of flexibility with regard to when the loan is repaid, but open bridging loans are riskier for the lender and therefore have higher overall borrowing costs.

With a closed bridging loan, the borrower agrees to repay the loan on or before a specific date. Such loans are considered lower-risk for the lender and are therefore usually more competitive in nature.

What’s the difference between first charge and second charge loans?

A first-charge loan is primarily taken out against an asset of value, such as a home or business property. For example, when you buy a home with a conventional mortgage, this is a first-charge loan: the first and only debt secured against your home.

If you then take out a bridging loan against the equity you have built up in your home (but while you are still repaying your mortgage), it will be issued as a second-charge loan. This is because there is already a primary debt (first charge loan) secured against your home, which, in the event your home is repossessed to repay your debts, will take priority.

Second-charge loans can be more difficult to secure than first-charge loans, and due to their higher risk, they can also be more costly than first-charge loans.

Who can qualify for bridging finance?

Bridging finance eligibility centres on the availability of assets of value to secure the loan and evidence of a viable exit strategy. Where both of these requirements are met, the applicant will most likely qualify, irrespective of their credit history and employment status.

Even so, the key to qualifying for a competitive bridging loan lies in comparing the market with the input and support of a specialist broker. This is particularly true where ‘ subprime’ bridging loan applications are concerned, but it also applies to mainstream bridging finance applications in general.

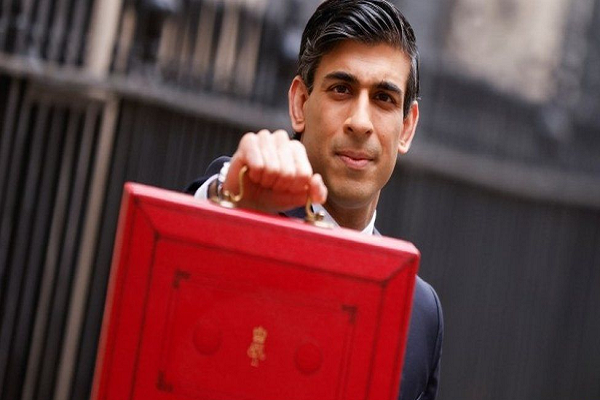

How the Budget is Likely to Affect the Housing Market

Things have been moving so fast as of late that it is difficult to believe it was only eight weeks ago that Kwasi Kwarteng devastated the UK economy with his catastrophic mini-budget. Since then, Jeremy Hunt has introduced a broad range of spending cuts and tax hikes with the aim of reversing at least some damage done by his predecessor and championing ‘stability, growth, and public services’.

According to the latest forecasts from the Office for Budget Responsibility, the UK is well and truly in recession, and inflation will likely level out at 9.1% at the end of this year.

As one of several measures brought into the housing market, the chancellor announced that the cuts to stamp duty, which Kwarteng announced would be permanent, would be phased out by March 2025. This basically means that a two-year time limit has been put on the cuts, after which they will be withdrawn.

Kwarteng had doubled the threshold at which stamp duty is paid to £250,000, while first-time buyers are also exempt from paying the first £425,000 of their purchase as long as the overall property price is below £625,000, rather than the previous £300,000.

Mr Hunt said that such an incentive will help support the housing market at a time when the economy needs it most, after which the gradual projected slowdown for the housing market over the next couple of years will render it less vital.

Figures from the OBR suggest that house prices could fall by as much as 9% between now and the third quarter of 2024, prompted largely by higher mortgage rates and a general lack of ability. The less competition there is for today’s excessively priced homes, the lower their prices will fall over time.

While a potential fall in average property prices of 9% seems steep, it is less so when put into perspective. Between the 12 months leading up to October this year, average property prices in the UK increased by a further 8.3%, according to data from Halifax.

Promising ‘to restore public finances and make the tax system fairer’, Mr Hunt also outlined a reduction in the previous tax-free allowance for capital gains tax (CGT), down from £12,3000 to £6,000 in 2023/24 and again to £3,000 in 2024/25. This is likely to have a significant impact on the general finances of second homeowners and landlords, who will be liable for larger payments upon selling residential properties.

But as the 28% CGT tax rate for higher-rate taxpayers has not been hiked, the outcome is not quite as bad as many had expected.

Elsewhere, the 45p rate tax threshold was reduced from £150,000 to £125,000, instantly moving a great many earners across the UK into the higher tax bracket. The chancellor declared that the inheritance tax nil-rate band would be frozen until the 2027–2028 fiscal year and that owners of electric vehicles would no longer be exempt from paying road taxes starting in 2025–2026.

What this means for the housing market

The combination of higher interest rates, higher taxes, and an elevated cost of living will undoubtedly have a knock-on effect on the housing market. People across the UK are already shelving their property purchases and investment plans indefinitely, and the trend is likely to continue for some time.

During this, a significant fall in average house prices is expected, but not so much as to reverse the extraordinary gains UK homes have collected over the past few years. Mortgage availability will likely increase as stability returns to the market, but most experts think the general picture will get worse before it gets better.

Small Housebuilders Blighted by Inaccessible Mortgages

Smaller housebuilders in the UK appear to be hindered from building new houses by problems related to mortgage accessibility, according to research performed by the Federation of Master Builders (FMB). After conducting a poll on 122 SMEs within the house building sector, the FMB found that 38% were finding mortgage accessibility issues a barrier to their planned projects.

Worse still, almost 50% said they expect the problem to worsen over the coming years.

62% of those polled said that lack of ‘available and viable’ land is the single biggest obstacle in the way of residential housing projects. 60% said the current planning system remains a major issue, while close to 50% said that the delivery of new projects is being hampered by a lack of skilled workers.

The government is being lobbied to alter its immigration policy to allow skilled workers into the UK to support the housebuilding sector, having once again failed to come anywhere near meeting its own long-promised annual housebuilding targets.

“This year’s FMB House Builders’ Survey highlights the persistent barriers holding back small, local house builders,” said Brian Berry, chief executive at the FMB.

“Delays in the planning system and a lack of available and viable land are stopping the industry from building the homes that are needed.”

“The lack of mortgage availability reveals the damage that the current economic turbulence has created.”

“A lack of skilled labour is another major barrier holding back the potential of SME house builders. This will come as a little surprise to many.”

“The government must look to develop homegrown talent, but targeted immigration has to be an option on the table to support the industry.”

“The government can achieve its ambitions for growth and levelling up by supporting the nation’s SME house builders.”

“Who better to invest in than local house builders, who act as the engines of growth in their communities, employing local workers, training local school teachers, and delivering quality homes?”

Rishi Sunak faces rebellion over housing policy

Meanwhile, Rishi Sunak is staring down the barrel of a major Tory MP rebellion, with more than 50 MPs calling for an amendment that would end housebuilding targets for local councils.

Led by the former cabinet minister Theresa Villiers, the amendment so far has the backing of 46 MPs, who want to see housebuilding targets made advisory rather than mandatory. The proposal has been met with disappointment and disdain from the opposition, with campaigners stating that it will cause further harm to the UK’s already struggling housing sector.

Damian Green, Esther McVey, Priti Patel, Chris Grayling, and Iain Duncan Smith are among the prominent names that have given their backing to the proposed amendment.

But rather than supporting the housing sector, critics are adamant that the amendment would further reduce the availability of affordable housing inventory across the UK.

“The actual effect would be to enshrine nimbyism as the governing principle of British society, to snap the levers that force councils to build, and to leave every proposed development at the mercy of the propertied and privileged,” commented Robert Colville, director of the CPS thinktank.

Meanwhile, former levelling-up secretary Simon Clarke expressed his own surprise and disdain for the amendment.

“There is no question that this amendment would be very wrong. I understand totally how inappropriate development has poisoned the debate on new homes in constituencies like Chipping Barnet [Villiers’ constituency], but I do not believe the abandonment of all housing targets is the right response,” he said.

“We also need to recognise the fundamental inter-generational unfairness we will be worsening and perpetuating if we wreck what are already too low levels of housebuilding in this country. Economically and socially, it would be disastrous. Politically, it would be insane.”

The shadow housing secretary, who characterised the entire situation as a move in the wrong direction, expressed similar sentiments.

“This is a complete shambles. The government cannot govern, the levelling-up agenda is collapsing, and the housing market is broken. Pulling flagship legislation because you’re running scared of your own backbenchers is no way to govern,” she said.

“There is a case for reviewing how housing targets are calculated and how they can be challenged when disputed, but it is completely irresponsible to propose scrapping them without a viable alternative in the middle of a housing crisis.”

“Labour will step up to keep this legislation moving. There is too much at stake for communities that have already been victims of Tory chaos and of a prime minister too weak to stand up to his own party.”

Average Rent Prices in London Hit Another All-Time High

Skyrocketing rent prices have been pricing prospective tenants completely out of much of the market for some time. Coupled with the escalating living-cost crisis, millions are finding it difficult (if not practically impossible) to make ends meet.

When and where the whole thing will begin showing at least modest signs of improvement remains to be seen, but things are almost certainly going to get worse before getting any better.

Younger people in the capital are finding themselves particularly hard hit, where the average cost of renting a home has always been disproportionately high. With average weekly rents having once again broken all records, a sizeable proportion of London’s private renting community is considering leaving the city entirely.

According to a new study conducted by the charitable foundation Trust for London, the average cost of renting a home in London is now £533 per week. This represents an increase of more than 16% since the same time last year, at which point private rentals were already completely unaffordable for many.

As a result, as many as one in four young renters are now saying they may be forced to leave London in the near future due to their growing inability to pay their bills and sustain their lifestyles.

Wages are insufficient to cover living costs

The study also indicated that between April and March this year, the average rental price for a one-bedroom property in London was the equivalent of just over 46% of the average Londoner’s gross median pay. By contrast, renters across the rest of the country use around 26.4% of their gross median pay for rent.

Reporting separately, Foxton Estate Agents said that one of the drivers behind skyrocketing rent prices in London was explosive demand, coupled with minimal available inventory. They said that around 23,000 rental properties were listed on the market in September, meaning that an average of 29 people were competing for each property listed.

There are approximately 9% fewer properties available on the private rental market in London than at the same time last year, while demand has increased by as much as 20 per cent.

Consequently, as many as 20% of younger people are planning on leaving London entirely, as they simply cannot afford to keep spending so much of their money on rent costs alone.

Prices are likely to continue rising

As more and more people pile back into big cities following the mass exodus prompted by the coronavirus crisis, average monthly rents in London are predicted to continue increasing.

Speaking on behalf of Hamptons, head of research Beveridge said that the return to the new normal would most likely continue pushing average London rental prices higher.

“With COVID-19 being pushed further to the back of people’s minds, life in the capital is slowly returning to its new normal. Tenants are returning to the bright lights of the city, and this is driving rental growth to record highs,” she said.

“The rise of remote working means that fewer tenants are moving to the capital specifically for work. In fact, a growing number of tenants choosing to live in London are working fully remotely and could live nearly anywhere in the country. The footloose nature of many jobs today means that it will be culture and lifestyle rather than employment that become the capital’s biggest draw.”

“The current pace of London rental growth is predominantly down to the capital playing catch up with the rest of the country.”

“Today, the average rent in London stands 103% above the average outside the capital. While this gap is up from 96% a year ago, it remains below the 120–30% pre-COVID-19 premium, which has been eroded by strong rental growth outside the capital in recent years. But the current pace of rental growth in London is likely to push the premium closer to its pre-COVID-19 level within two years.”

How to Fix a Broken Property Chain with a Bridging Loan

For some time, investment property purchases have been the most common use for bridging finance in the UK. More aspiring and established investors than ever before are looking to leverage the explosive competition in the UK housing market, using fast-access bridging loans to fund time-critical property purchases.

Meanwhile, a growing contingency of homeowners is turning to bridge finance for an entirely different reason. Second only to investment property purchases, breaking free of property chains is now the second most common reason for taking out a bridging loan.

During the first six months of the year, at least one in every five bridging loans was issued for this purpose.

The risk of broken property chains

Never has competition for quality homes in desirable parts of the UK been greater. Even so, there are no guarantees at any point during the property purchase process that the transaction will go through.

Incredibly, research suggests that up to 25% of all residential property sales fall through due to broken property chains. The longer and more complex the property chain, the higher the likelihood of one or more links being compromised.

A property chain is defined as “a line of buyers and sellers linked together because each is selling and buying a property from one of the others.” When buying or selling a home, you are at the mercy of every other buyer and seller within the same property chain.

Should any property sale or purchase fall through before your own transaction is complete, it may be rendered unviable.

Why do property chains collapse?

Nobody lists a property for sale with the intention of the transaction falling through. Even so, there are many reasons why a property chain can and does collapse with such regularity.

Typical examples of this include the following:

- A change of circumstances for the buyer or seller, rendering them unable to continue with the transaction.

- The buyer or seller of a property simply changes their mind at some point during the deal and withdraws from the chain.

- A competing bidder submits a higher bid that is accepted by the sellers, despite them having already agreed to sell the property to someone else.

- Mortgage applications may encounter disruptions and delays, or a decision in principle may be reversed for any number of reasons.

- A survey conducted on a property may uncover unexpected problems and structural issues, rendering the agreement null and void.

In each of the above instances, the property chain comes crashing down and brings all sales and purchases therein to a grinding halt.

Fixing property chains with bridging finance

This is where bridging finance can offer an invaluable lifeline to those looking to escape the trappings of the conventional property chain. With a bridging loan, you borrow money against the value of your current home, which is used to purchase your next property for cash.

Along with speeding up the purchase process, these types of transactions are in no way reliant on any other buyers or sellers. In addition, cash buyers are often afforded additional incentives by sellers looking to complete transactions on their homes as quickly as possible (often up to 2% off the home’s standard purchase price).

For faster and more convenient than a conventional mortgage, a bridging loan can be organised and accessed within a few working days. The full balance is then repaid when the borrower’s previous property sells for its full market price, a few weeks or months down the line.

“I’m not surprised that chain-break finance is one of the top reasons to use bridging loans. Property transactions are booming, and we’re seeing a large number of solicitors trying to exchange and complete on the same day,” said Dale Jannels, Managing Director of Impact Specialist.

“This inevitably will result in people pulling out of purchases late on, and therefore clients need a short-term loan to fill the gap their buyer left behind.”

Bridging Loan Borrowing Is Up 22%, But Why?

All indications point to another buoyant year for bridging finance, following another major spike in loan applications. On the whole, the total value of the UK’s bridging sector has grown by as much as 22% over the past 12 months alone. More private borrowers and commercial customers are taking out bridging loans than ever before, but why?

Bridging finance differs from most conventional loans and mortgages in that it is a strictly short-term facility. Typically issued over a term of 12 months or less, bridging finance is also comparatively quick and easy to arrange. With all the essential paperwork and supporting documentation in place, the funds that are needed can be accessed within a few working days.

Coupled with monthly interest as low as 0.5%, the appeal of bridging finance is easy to understand; the more difficult and expensive it becomes to borrow money from major High Street banks, the more business flows the way of the UK’s thriving bridging sector.

A major spike in loan completions and applications

The most recent raft of figures suggests that between Q1 and Q2 this year, total bridging loan values swelled from £156.8 million to £178.4 million. This represents a growth of 13.8% over the course of three months alone. Year-on-year, total lending volumes skyrocketed by approximately 21.8% between Q1 2021 and Q2 2022.

Even so, there is still some way to go until the sector reaches pre-pandemic performance, having hit an all-time record performance of £180.9 million in Q4 2019.

As for why so many people are taking their business to bridge loan specialists, purchasing investment properties remains the single most common application for bridging finance. Following the trend of several previous consecutive quarters, investment property purchases once again accounted for almost a quarter of all bridging loans taken out in Q2 this year. This includes landlords purchasing properties to let out to tenants and investors looking to flip homes for capital gains.

Meanwhile, 21% of bridging loans issued in Q2 were used to help homebuyers break out of property chains. With competition in the housing market at an all-time high, more homeowners than ever before are using bridging finance to tap into the equity they have tied up in their homes and beat competing bidders to the punch.

Funding significant property improvements and refurbishments remained a popular use for bridging finance during Q2, accounting for around 30% of all loans issued.

A gradual decline to come?

Speaking on behalf of Henry, Director Geoff Garrett suggested that while the immediate outlook for the bridging sector is bright, the coming months could bring a gradual slowdown in overall activity.

“An increase in bridging loans does not signify that people are struggling financially. Such loans are taken in order to fund major purchases or investments but can only be granted to people who can prove they have larger, longer-term loans coming their way, such as a mortgage,” he said.

“Instead, an increase in bridging loan totals indicates that the systems in place are struggling to keep up with demand and can’t match the desired pace of buyers and sellers. The housing market, for example, is moving more slowly than it did a year ago, even two and three years ago. At the same time, buyer demand is extraordinarily high, and activity is through the roof. This causes delays in the conveyancing and buying process, which, in turn, increases the need for bridging loans.”

“However, with the cost of living and interest rates rising so rapidly, one has to expect to see a slight drop-off in buyer demand and, therefore, a decline in bridge financing over the next year or so.”

Mortgage Lenders Pull Mortgages as Unstable Property Market Continues to Cause Havoc for Buyers

A chaotic financial market has led many mortgage lenders to remove the availability of many mortgage products for new buyers following the Chancellor’s mini-budget announcement, released last week. Although thought to be a temporary measure by lenders, this is bad news for buyers wishing to find good deals when looking for new mortgage products.

The UK’s largest lender, Halifax, has removed all fee-paying products and replaced them with full fee-paying mortgage products. This means that customers can no longer pay an arrangement fee in return for a better (lower) interest rate than was previously available.

In an extreme move, Skipton Building Society and Virgin Money have taken the step of removing their entire range of products with the aim of relaunching new products later in the week.

The announcement from Kwarteng has sent the value of the pound and government bonds into free fall. The mini-budget was said to be created to help the growth of the economy by funding tax cuts with government lending.

“As a result of significant changes in the cost of funding, we’re making some changes to our product range,” a Halifax spokesperson said.

The 5-year government bond yield increased by a whopping 96 basis points on Monday and Friday, signifying the highest rise in borrowing costs since 1987, the year that Refinitiv began.

“Following last week’s (Bank of England) meeting and the government’s subsequent mini-budget, we continue to see the market response unfold,” Skipton Building Society said in an email to brokers.

“In response, we will be temporarily withdrawing our new business product range with immediate effect.”

New customers were advised that Virgin Money was intending to pull its mortgage products at 8 p.m. on the 26th.

“We continue to monitor the situation closely and currently plan to relaunch products for new customers towards the end of the week,” Virgin Money said.

Mortgage brokers advised that the likelihood of lenders making significant changes to mortgage product offerings was high.

“The uncertainty around the risk of an emergency rate rise is likely to see other lenders withdrawing products or increasing rates dramatically until they know the extent of how this all pans out,” said Jamie Lennox, director of Dimora Mortgages, a broker.

The Bank of England has suggested that they will adjust interest rates in order to bring inflation back to target levels.

“That will feed into higher mortgage rates, and, as always, it’ll be the taxpayer left carrying the can,” said Lewis Shaw, founder of broker Shaw Financial Services.