Searches for Development Bridging Back in the Top Five

Specialist brokers operating within the bridging sector have noted a major spike in activity and interest among property developers. As a result, and for the first time since February 2019, development finance is back within the top five search terms within the bridging category.

According to Knowledge Bank, which recently revealed the top-performing search terms for January 2021, there has been a significant increase in the number of searches targeting ‘development bridging and, in particular, the maximum loan to GDV, i.e., the LTV against end value’. This suggests that bridging finance is being sought by construction companies and developers for major property development and redevelopment projects.

This was the first time this particular term had appeared within the top five in two years.

No change at the top

The top three search terms remained the same for January 2021, which according to Knowledge Bank were ‘maximum ‘LTV’,’regulated ridging’, and ‘regulated bridging’ and ‘minimum loan amount’; however, the order of the three top searches changed from the month before, suggesting a shift in priorities among applicants.

In the commercial lending segment of the market, the three most popular search terms, according to Knowledge Bank”, were semi-commercial’,’ maximum LTV for commercial investment’, and ‘minimum loan amount’. A new entry to the top five for January was ‘commercial owner-occupier’.

‘First-time buyers’ also made an entry to the top five searches conducted in the buy-to-let segment for the first time since February last year. The most popular search term in the BTL bracket was ‘lending to limited companies’, which, according to Knowledge Bank, reflects the growing number of landlords looking to set off companies prior to the planned punitive tax changes.

The importance of specialist broker support

Commenting on the data, Knowledge Bank highlighted the growing importance of seeking independent specialist support to access a competitive deal from a reputable lender.

“With the end of both the stamp duty holiday and furlough scheme [in sight], lenders are certain to continue adapting criteria to keep up with the evolving market,” commented Knowledge Bank’s operations director, Matthew Corker.

“It is now physically impossible for any mortgage broker to keep all the different criteria in their heads.”

“So, it is now more important than ever for brokers to use a comprehensive criteria search system to ensure they can provide their clients with the best advice and evidence that they have done so.”

As many bridging loan specialists in the UK operate exclusively via established brokers, their products are only available with broker representation. Comparing the market with the support of a broker can be beneficial in a variety of ways, including access to objective and impartial advice on the funding solutions available.

For more information on any of the above or to discuss the potential benefits of bridging finance in more detail, contact a member of the team at ukpropertyfinance.co.uk today.

How to Get a Bridging Loan for a London Property

With monthly interest rates hovering at an all-time low, there has never been a more cost-effective time to consider bridging finance.

Particularly where the funds are required quickly and for a major purchase or investment, bridging loans offer an invaluable lifeline for both private borrowers and commercial customers.

Getting a bridging loan as a homeowner

Accessing bridging finance as a homeowner is relatively straightforward and can be used for a wide variety of projects or purposes.

For example, one of the most common applications for bridging finance as a homeowner is to renovate a property before listing it for sale to achieve the maximum market value. Another use for bridging finance would be to prevent a chain break, enabling dream houses to be purchased before the sale of a current property has been finalised.

Bridging loans are also commonly used in the same way for downsizing. Buy a property at a competitive price with a bridging loan, repay the funds with the sales proceeds of your former home, and retain the remaining proceeds from the sale.

It is even possible to use bridging finance to upgrade or extend your current home before subsequently paying off the loan with a longer-term financial product (like a secured loan or mortgage) to repay the balance over several years or by sale once the work is complete.

Provided you have sufficient equity in the security being offered, you should be accepted for bridging finance. Even if your credit report is imperfect, this will not necessarily prevent you from accessing a competitive bridging loan.

Getting a bridging loan as an investor

Bridging finance is increasing in popularity as a popular purchase tool for investors. As conventional mortgage products and high-street loans become increasingly difficult to access, the flexibility of bridging finance gains further appeal.

Investors looking to purchase properties in London often have limited time to make decisions and access the funds needed. Particularly when it comes to last-minute property purchases like those at auction, waiting weeks or months for a mortgage to be formalised simply is not an option.

In this scenario, bridging finance can help, as it can be secured against any viable property the investor owns, and the finance can be arranged within a matter of days. Whether looking to ‘flip’ a property purchased in poor condition for a profit once renovated or to purchase and resell an auction property of any kind, bridging finance holds the key to fast and affordable investments in London.

Key criteria…

In both instances, the main requirement that must be fulfilled is ownership of acceptable property. A bridging loan can be secured against almost any type of residential or commercial property, often irrespective of type, purpose, and even condition.

Ensuring you get the best possible deal means shopping around with the help of an experienced broker, who compares the market in its entirety on your behalf. Always remember that many specialist lenders work exclusively via established brokers, meaning their products and services are not available directly to the public.

For more information on any of the above or to discuss your requirements in more detail, book your obligation-free consultation with UK Property Finance today.

Bridging Sector Bouncing Back After £278m Fall in 2020

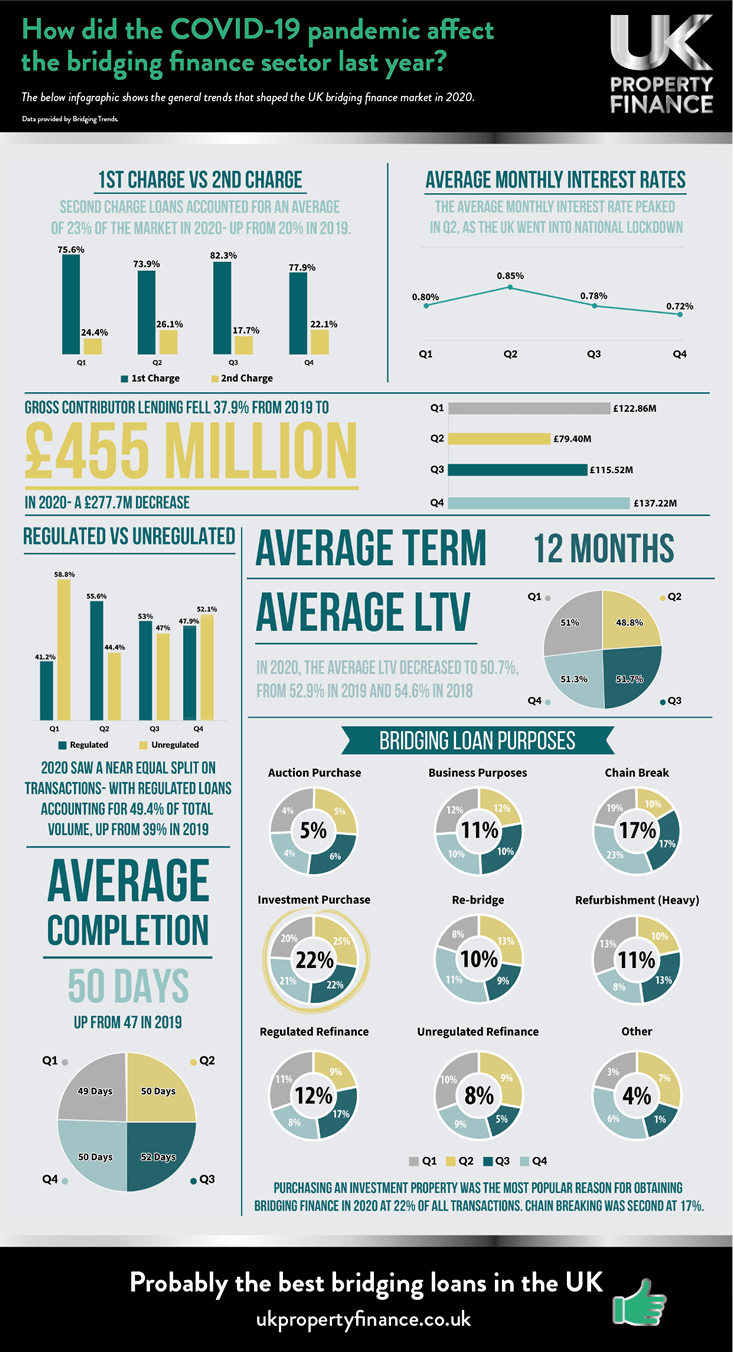

Almost every arm of the financial services sector in the UK was adversely affected by COVID-19 last year. The bridging finance segment was no exception, which, according to the latest figures from Bridging Trends, fell by £278 million compared to 2019.

(Click image for full-size version.)

In total, bridging loans valued at £455 million were provided by the lenders incorporated in the Bridging Trends annual survey, down from £732.7 million in 2019, or 38%.

Q1 saw total bridging finance transactions hit just under £113 million before experiencing a major fall to just £79.4 million in Q2. Transaction volumes increased significantly in Q3 to reach approximately £115.5 million and climbed to £137.2 million during the last three months of the year.

Regulated vs. unregulated bridging loans

Interestingly, 2020 bucked the trend of previous years by recording a near-identical split between unregulated and regulated bridging transactions. Regulated bridging loans accounted for 36% and 39% of transactions in 2018 and 2019, respectively; last year’s regulated market share was 49.4%.

Borrowers typically found themselves paying more for bridging finance during the first half of the year. According to Bridging Trends, average interest rates during the first three months of 2020 were 0.8% per month, increasing to 0.85% per month in the second quarter. This was followed by 0.87% in the third quarter and a fall to 0.72% in Q4.

The average LTV on bridging loans issued last year was down somewhat compared to previous years, which were recorded at 55.6% in 2018, 52.9% in 2019, and 50.7% in 2020.

An optimistic outlook

With interest rates hovering at all-time lows and activity levels once again returning to normal, the immediate outlook for the bridging sector has been called encouraging by most, with some suggesting that the current positive performance could extend far beyond the looming stamp duty holiday deadline.

“The impact of the pandemic on the bridging sector is shown clearly in Q4’s data, but it also alludes to the activity we are now experiencing, some of which, but not all, is related to the stamp duty holiday deadline.”

“It’s clear though that bridging finance is becoming better understood by the wider broker market (not just those in the specialist sector), and there is more confidence about the options it can provide customers, which should mean that 2021 could see a real watershed moment for this type of finance.”

Some have shown surprise that such a buoyant sector experienced such a dramatic decline in the first place, with comments such as:

“I am surprised that the fall in lending in 2020 was so great. The market has always ‘felt busy’ and we did not see such a big drop in volumes.”.

“Some big names in bridging closed their doors, and some are still not back as they were; however, most of the short-term lending market either carried on throughout or paused only temporarily as working practices were refined and made fit for purpose under the restrictions we faced.”

“The absence of some big names reduced supply, and coupled with restricting loan to value, this has had a marked impact on lending levels, which is also reflected in the fall in average loan to value over the year. However, as the trend in Q3 and Q4 indicated, we believe volumes will bounce back quite quickly, and with people re-entering the market, the data is reflecting the stiff competition lenders face for business in terms of lower interest rates.”

The Big Question: Renovate or Relocate?

For some, lockdown provided the perfect opportunity to take stock of what matters and appreciate their homes in an entirely new way. For others, the whole situation made it abundantly clear that they simply were not happy with where they lived.

COVID-19 has forced millions to revisit what we expect, what we want, and what we need from our homes. Particularly with more people than ever now working from home on a semi-permanent basis, many homeowners are struggling with the space they have available.

In which case, there are two primary options to choose from: relocate or renovate. both of which can be advantageous in their own unique ways.

Relocating in the current climate

While COVID-19 has brought about inevitable obstacles and challenges for those considering relocation, there is also one major home-buying benefit to consider right now. The temporary stamp duty holiday introduced by the chancellor has removed all stamp duty liabilities for anyone purchasing a property with a market value of £500,000 or less.

This amounts to a significant discount on the overall purchase price for most buyers until March 31 next year.

In addition, lenders in general are currently willing to accept relatively low down payments of 10%–15%. Although some continue to demand 20% or even 25%, there are affordable options available for movers and first-time buyers alike.

Comparing the market with the help of an independent broker is essential to getting the best possible deal in the current climate.

Renovating your existing home

Of course, there are many instances in which conducting renovations and home improvements could be more cost-effective than relocating. For those considering renovating their existing home, experts advise first establishing whether the structure of the property is suitable for the proposed alterations.

This will typically mean arranging an inspection and survey of your property and having an independent contractor look at and guide you through the options available.

Some smaller extensions may not require planning permission, though it is still advisable to make the necessary inquiries to ensure you do not contravene restrictions in your area.

Funding major home improvements and renovations has the potential to be easier and more affordable than obtaining a conventional mortgage. By securing a property development loan against the value of your home, you will have access to competitive rates of interest and low overall borrowing costs.

Compare the market

Whether you have extensive renovations in mind or are considering relocation, we can help you find the best possible deal to suit your objectives and your budget. At UK Property Finance, we work with an extensive network of specialist lenders across the UK, scouring the market in its entirety to find unbeatable deals on all types of mortgages and home improvement loans.

For more information or to discuss your requirements in more detail, contact a member of the team at UK Property Finance today.

2019’s Most Important Bridging Trends

Both in an economic and political sense, 2019 will go down in history as one of the UK’s most unstable periods. This did not stop bridging finance activity once again, showing remarkable strength and resilience, with the sector having performed better than expected throughout the entire 12-month period.

This is perhaps attributed in part to the fact that average monthly interest rates on bridging loans fell to new record lows in Q1 and Q3—0.74% during both quarters. Stricter borrowing criteria on the High Street may have also contributed to the strong performance, which is now lined up for an even more impressive 2020.

Heavy activity and growing regulation

In total, the bridging finance sector issued loans with a combined value of £732.7 million last year. Of these, approximately 39% of all transactions represented impressive growth from the 36% recorded in 2018. The highest levels of bridging loan activity were recorded during the first three months of the year, totalling approximately £185.32 million in loans issued.

There were no big changes in applicants’ motivations for taking out bridging loans last year, as the following figures demonstrate:

- Auction purchases: 7%

- Investment purchases: 23%

- Business purposes: 9%

- Chain break: 18%

- Heavy refurbishment: 14%

- Re-bridge: 11%

- Regulated refinance: 6%

- Unregulated refinance: 9%

- Other: 5%

On the whole, the most popular reason for applying for bridging finance throughout each quarter of the year was to purchase an investment property (23%). Interest rates across the board remained lower than in 2018 throughout the year, averaging 0.76% for the year, down from 0.81% in 2018.

Average LTV is decreasing.

Interestingly, the average LTV requested on bridging finance in 2019 fell from 55% to 53%. This indirectly suggests that applicants are actively seeking lower contributions to planned purchases and investments rather than taking on unnecessary debt.

It was also noted that the average completion time for a bridging loan in 2019 had increased to 47 days from the previous year’s 45 days. The average loan term for bridging finance last year stood at 12 months, up from the 11-month average of 2018.

Second-charge loans occupied a significantly bigger share of the bridging market in 2019, accounting for around 20% of all loans issued in 2019—an increase from the 17% recorded a year earlier.

Compare the market with UK Property Finance.

The key to accessing the best possible deal on a high-quality bridging loan continues to lie in comparing the market in its entirety. At UK Property Finance, our experience and expertise extend to all types of bridging loans for all purposes.

We will help you find an unbeatable deal by comparing exclusive offers from our extensive panel of lending partners across the UK. For more information or to discuss your requirements in more detail, contact a member of the team at UK Property Finance anytime.

Regulated Bridging Loan Helps Couple Create Their Dream Home

UK Property Finance recently helped a newlywed couple purchase and refurbish the property of their dreams. The couple had found their perfect home in a desirable area of Suffolk where they had previously lived and which was being marketed at a price within their budget due to the updating work required.

When the couple approached UK Property Finance, they had already received three estimates for both the timescale and the costs involved in the refurbishments. They also had savings to cover the renovations in full.

To prevent missing out on the property, the clients had to provide proof of funds to the estate agent and, as such, needed an agreement in principle for a loan of £500,000 as quickly as possible. We provided a quotation for a bridging loan within a matter of hours, and to obtain a market-leading rate, this loan was to be secured as a first charge on both the new property and the buy-to-let property they had inherited several years earlier. Their exit strategy was clearly defined as the loan would be repaid in full by the sale of their current home, which, after deductions, would have sufficient equity remaining to clear the bridging loan in full. The bridging loan was arranged with a term of 12 months; however, interest would only be generated while the loan remained unpaid, and as the current residential property sold within 3 months and 3 days of the loan being funded, only 3 months and 3 days of interest were generated, not the full 12 months of the agreed term. This made the recommended bridging loan a highly cost-effective way of funding the client’s short-term requirements.

The loan transaction was completed quickly and without problems, and the couple was able to purchase their dream property and commence the renovations needed prior to moving in. All renovations were completed by the time the sale of the current residential property was completed, enabling the clients to seamlessly move from old to new.

Bridging Loan Helps Business Partners Get New Venture Underway

At UK Property Finance, we are always proud to be part of a small business success story. In this instance, we were approached by two lifelong friends who had decided to go into business together. Both experienced tradesmen and those in their mid-30s believed that the time had come to invest in property, in particular purchasing properties in need of renovation or upgrades. This would enable them to utilise their skills in order to create maximum profit when they sell.

One of the partners owned commercial property inherited from a deceased relative several years prior. The other partner had considerable savings, although even the combination of equity and savings was not enough to purchase a property outright and pay for the renovation work needed. The partners approached UK Property Finance for advice, and based on their scenario, we advised that a short-term bridging loan would be the most appropriate product for them.

The loan was secured against the first partner’s commercial property, while the second partner’s savings were used for the 10% deposit required for an auction purchase and the balance to minimise the loan required and Loan to Value (LTV) so that UK Property Finance could recommend the best interest rates available in the market and also raise the money needed to complete the renovation work. The loan was finalised from start to finish within 2 weeks, and the funds were transferred, allowing the new business partners to take formal ownership of their first investment property well before the 28 days allowed by the auction house, as such, they commenced the refurbishments earlier than expected.

We have kept in regular contact with this new fledgling business, which is well on with its first development and already on the lookout for number two.

Secured 2nd Charge Mortgage Loan Assists Self-Employed Client’s Purchase of First Buy to Let Property Investment

The UK’s buy-to-let market continues to prove a goldmine for those making the right moves at the right time. UK Property Finance recently helped a client from London collect the keys to his first buy-to-let investment property purchase.

The client had significant equity tied up in his residential home, which could be released. He also had a large number of free funds, which, when combined, created a sizeable deposit, giving our client the opportunity to use products with the best possible interest rates. To access the equity tied up in his own home, we suggested a second-charge mortgage loan secured against the client’s home.

We chose a 2nd charge mortgage loan instead of a full remortgage as UK Property Finance has access to second-charge mortgage lenders who will allow loan sizes of 6 or 7 times an applicant’s income to be raised at highly competitive rates of interest.

This meant that our client could raise a larger deposit via a second-charge mortgage loan than if he had fully remortgaged. Additionally, despite being self-employed, our client was able to verify his income using his 1-year SA302 tax returns. With our contacts, this made it quick and easy to arrange the loan needed to purchase the investment property, and the application for £280,000 was approved and the underwriting process was completed in less than five working days.

During the process, the client admitted that he was rejected by three lenders beforehand, simply due to his self-employed status. He was delighted with the result we achieved and left the team at UK Property Finance a glowing Trustpilot review for giving him the opportunity to access the buy-to-let property ladder for the first time. Work out the costs of a mortgage using our UK mortgage calculator.