How the Budget is Likely to Affect the Housing Market

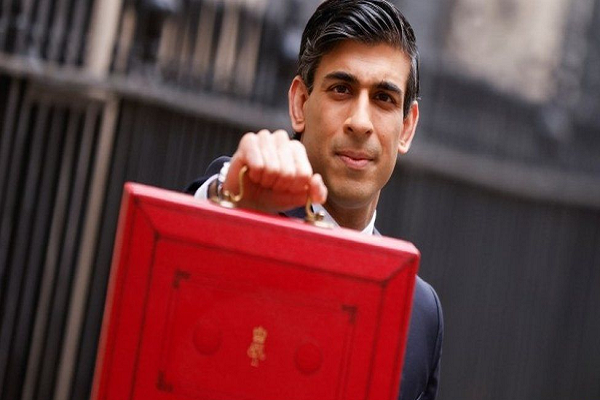

Things have been moving so fast as of late that it is difficult to believe it was only eight weeks ago that Kwasi Kwarteng devastated the UK economy with his catastrophic mini-budget. Since then, Jeremy Hunt has introduced a broad range of spending cuts and tax hikes with the aim of reversing at least some damage done by his predecessor and championing ‘stability, growth, and public services’.

According to the latest forecasts from the Office for Budget Responsibility, the UK is well and truly in recession, and inflation will likely level out at 9.1% at the end of this year.

As one of several measures brought into the housing market, the chancellor announced that the cuts to stamp duty, which Kwarteng announced would be permanent, would be phased out by March 2025. This basically means that a two-year time limit has been put on the cuts, after which they will be withdrawn.

Kwarteng had doubled the threshold at which stamp duty is paid to £250,000, while first-time buyers are also exempt from paying the first £425,000 of their purchase as long as the overall property price is below £625,000, rather than the previous £300,000.

Mr Hunt said that such an incentive will help support the housing market at a time when the economy needs it most, after which the gradual projected slowdown for the housing market over the next couple of years will render it less vital.

Figures from the OBR suggest that house prices could fall by as much as 9% between now and the third quarter of 2024, prompted largely by higher mortgage rates and a general lack of ability. The less competition there is for today’s excessively priced homes, the lower their prices will fall over time.

While a potential fall in average property prices of 9% seems steep, it is less so when put into perspective. Between the 12 months leading up to October this year, average property prices in the UK increased by a further 8.3%, according to data from Halifax.

Promising ‘to restore public finances and make the tax system fairer’, Mr Hunt also outlined a reduction in the previous tax-free allowance for capital gains tax (CGT), down from £12,3000 to £6,000 in 2023/24 and again to £3,000 in 2024/25. This is likely to have a significant impact on the general finances of second homeowners and landlords, who will be liable for larger payments upon selling residential properties.

But as the 28% CGT tax rate for higher-rate taxpayers has not been hiked, the outcome is not quite as bad as many had expected.

Elsewhere, the 45p rate tax threshold was reduced from £150,000 to £125,000, instantly moving a great many earners across the UK into the higher tax bracket. The chancellor declared that the inheritance tax nil-rate band would be frozen until the 2027–2028 fiscal year and that owners of electric vehicles would no longer be exempt from paying road taxes starting in 2025–2026.

What this means for the housing market

The combination of higher interest rates, higher taxes, and an elevated cost of living will undoubtedly have a knock-on effect on the housing market. People across the UK are already shelving their property purchases and investment plans indefinitely, and the trend is likely to continue for some time.

During this, a significant fall in average house prices is expected, but not so much as to reverse the extraordinary gains UK homes have collected over the past few years. Mortgage availability will likely increase as stability returns to the market, but most experts think the general picture will get worse before it gets better.