Record-High Mortgage Lending Activity Recorded in Q1

Mortgage lending activity attributed to home movers reached an all-time high during the first three months of this year as homeowners across the UK set their sights on more spacious homes with private gardens.

According to the latest figures published by the Financial Conduct Authority (FCA), movers accounted for 42% of total mortgage lending activity during Q1 2021. This is an enormous leap from the 27% recorded during the same period last year and the highest since records began in 2007.

Meanwhile, data from Halifax indicates another significant spike in average house prices, potentially pricing many first-time buyers out of the market. The average market value for a UK home increased by more than £22,000 over the past year, reaching a new all-time high of £261,743 during May, according to Halifax.

Consequently, the share of loans issued to first-time buyers during that time increased by just 2% compared to the same period in 2020.

Shifting property purchase intent

Figures published by Zoopla indicate a major shift in property purchase intent among UK movers and buyers, which is not being matched by supply. This is resulting in significant increases in average house prices in key regions across the country, making it difficult for first-time buyers to find homes within their budgets.

Over the past four years, the number of 3- and 4-bedroom family homes available on the UK market has declined significantly each year. Meanwhile, smaller flats with 1 to 3 bedrooms are currently on the market than at any point since 2017, as buyers set their sights on spacious homes away from busy urban centres.

The market is also being fuelled by the impending deadline of the government’s temporary stamp duty holiday. Even then, many economists and lenders believe that the momentum the real estate sector has built over recent months will carry it through until the end of the summer, at least.

Even in the face of major economic uncertainty in the wake of the pandemic, official figures indicate the fastest average UK house price growth in more than a decade.

Strong performance throughout Q1

According to the figures published by the Financial Conduct Authority, total mortgage lending activity for Q1 this year was around 26.5% higher than the first three months of the year in 2020. A total of £83 billion was borrowed by the UK public in the form of mortgage products across all classifications.

Remortgaging activity fell significantly during the same period, having plummeted 14% compared to the same time last year. This is the worst performance for this section of the market since 2007.

Meanwhile, the share occupied by buy-to-let property owners remained relatively stable, while first-time buyer mortgage activity increased only slightly compared to last year.

House Prices in May Reach New Record Levels

The month of May has seen yet another hike in the average price of properties, reaching a record of £261,743, according to Halifax’s latest house price index figures. This is the strongest level seen in almost 7 years, with house price inflation rates rising by 9.5% over the last year.

During May, a significant increase in year-on-year house prices was seen in all regions of the UK, except for the North East. Wales once again showed the highest growth, with an impressive 11.9% rise in the last year. Not far behind were the North West and Humberside, with both areas reporting double-figure inflation on property prices. For the North West and Wales, these figures indicated the best gains seen since April 2005, while for Humberside, the property market has not seen rises like this since June 2006.

While the North of England is thriving, the South is not fairing as well, especially in the case of Greater London, where, although prices are up 3.1% from last year, it is still somewhat lagging behind the rest of the country. This is likely due to the shifting preference for property types due to changing work habits and lifestyles following the pandemic. With more buyers working from home, the demand for city properties has significantly decreased, with preferences steering more towards larger properties with outdoor spaces in suburban and rural areas away from big cities. Brexit and additional stamp duty surcharges for non-UK citizens will have no doubt also had a negative effect on overall property sales in London.

Russell Galley, Managing Director, Halifax, stated:

“House prices reached another record high in May, with the average property adding more than £3,000 (+1.3%) to its value in the last month alone. A year after the first easing of national lockdown restrictions and the gradual reopening of the housing market, annual growth surged to 9.5%, meaning the average UK home has increased in value by more than £22,000 over the past 12 months.

“Heading into the traditionally busy summer period, market activity continues to be boosted by the government’s stamp duty holiday, with prospective buyers racing to complete purchases in time to benefit from the maximum tax break ahead of June’s deadline, after which there will be a phased return to full rates. For some homebuyers, lockdown restrictions have also resulted in an unexpected build-up of savings, which can now be deployed to fund bigger deposits for bigger properties, potentially pushing property prices even higher.

“While these effects will be temporary, the current strength in house prices also points to a deeper and longer-lasting change as buyer preferences shift in anticipation of new, post-pandemic lifestyles: As greater demand for larger properties with more space might warrant an increased willingness to spend a higher proportion of income on housing,

“These trends, coupled with growing confidence in a more rapid recovery in economic activity if restrictions continue to be eased, are likely to support house prices for some time to come, particularly given the continued shortage of properties for sale.”

Director of Sales at Specialist Lender Together, Sundeep Patel, explains:

“The surge in demand for property we’re continuing to see showed no indication of slowing last month. House prices reached another record high in May, up by 1.3% (more than £3,000) in value than in April. Annual growth also surged by 9.5%, with the average house price in the UK now at £261,743. However, with the stamp duty tax break starting to taper off at the end of this month, we’re likely to see this unprecedented rush for new homes ease off by the time we hit the end of summer. The recently released travel traffic light list for UK holidaymakers may also dampen activity as people prepare to make a break for guaranteed sun and so stick a pin in their property plans back home.

“How the property market will shape up by the end of this year is no way near certain. However, whether house prices have been artificially inflated or not, it is possible the backlog in demand from keen buyers will markedly increase opportunities for specialist lenders as increased volumes of borrowers turn to finance, such as bridging loans, to quickly purchase their ideal homes.”

SPI Capital’s CEO of Asset Management, Anne Claire Harper, adds:

“Investors and homeowners alike are wondering whether the housing market boom is about to bust. With 9.5% house price growth in the year to May, despite the huge economic problems caused by the pandemic, it’s a sensible question.

“The truth is, what tends to happen in the housing market is different from what happens with other purchases and investments. In other sectors, when consumers get nervous, they stop spending so much. When investors get nervous, they are scared to sell. Things are different in the housing market because homes are ‘essential’. We all need a place to call home.

“So, unlike crypto ‘investments’ or shares, people tend not to sell unless they really need to. And, with interest rates low and forecast to remain so, it can be cheaper to pay a mortgage on an equivalent property than to pay rent. So a mass sell-off from property owners who have already managed to put down a deposit seems unlikely unless interest rates rise significantly.”

‘According to Halifax, average annual house prices are at a historic high, at £261,743, which will seem unaffordable to many—in particular, younger people. A big cause of growth over the past year has been the desire for more space, and for those not moving, home renovations are increasingly popular. This is symbolic of our rising living standards, which is, on the whole, a good thing. As a result, house prices and construction costs are rising. This means, in turn, that the cost of renting, buying, and improving homes is likely to continue to rise.”

Simple Steps to Reduce Debt, Starting Today

May brings Debt Awareness Week, during which struggling debtors across the UK are encouraged to take proactive steps to improve their financial circumstances.

According to Step Change, the economic effects of the pandemic are likely to be felt by millions of households for many years to come.

“This Debt Awareness Week, we are focusing on breaking down the stigma that surrounds debt, opening up the conversation, and encouraging people to take #TheFirstStep towards resolving their money worries,” commented Richard Lane, director of External Affairs at Step Change.

“With the week also marking a year since lockdown began in England and Wales and 2.5 million people facing a financial crisis due to the impacts of the coronavirus, it’s important that households across the country know where to get help. You are not alone.”

The charity also outlined a series of simple yet effective steps for reducing debt and restoring financial control, including the following proactive measures:

- eliminate unnecessary outgoings

The key to bringing debt under control lies in first eliminating as many unnecessary and avoidable outgoings as possible. This is where it can be useful to create a list of all monthly expenses and separate them into two categories: needs and wants. After which, anything within the latter that does not qualify as essential can either be minimised or halted entirely.

- Transfer credit card debt

One of the best ways to minimise credit card debt is to transfer the outstanding balances of one or more existing credit cards to a new card with an introductory 0% interest rate. Often valid for a year or so, this 0% period provides plenty of opportunity to gradually pay off at least some credit card debt without incurring any interest in the meantime.

- Consolidate debts with an affordable loan

Specialist-consolidation loans often leave a negative mark on a person’s credit report. With interest rates hovering at all-time lows, an affordable personal loan could be used right now for exactly the same purposes without the risk of credit score damage. Unsecured loans from major high-street lenders are currently hovering around the 3.5% APR mark, which could add up to significant savings if you are currently repaying debts with much higher rates of interest.

- Clear smaller debts where possible

It can also be useful to make the effort to clear as many smaller debts as possible, eliminating interest rates and borrowing costs in the process. An affordable overdraft can still constitute an unnecessary expense—a debt that should be cleared if it is possible to do so.

- Speak to your creditors

Last but not least, anyone who is having genuine difficulties keeping up with their outgoings should consult with their creditors at the earliest possible stage. Some may be willing to offer a temporary payment break at no extra charge while you get your finances in order. Others may be happy to negotiate a reduced monthly payment; it may also be worth consulting with an independent broker before applying for any type of consolidation loan in order to ensure you get the best possible deal.

Halifax Reports a New Record-High Average UK House Price of £258,204

New figures from Halifax suggest that the clamour to claim stamp duty relief before the September deadline shows no sign of abating. As a result, a major spike in demand for desirable properties in key regions has resulted in a huge 8.2% average house price increase within the past 12 months.

This means that the average price of a home in the UK is now £20,000 higher than it was at the same time last year, the fastest rate of growth recorded in five years.

Market watchers have since commented that the momentum is being driven by widespread fear of missing out and a collective desire among movers and first-time buyers to capitalise on the temporary stamp duty holiday.

In addition, the fact that average house prices are climbing so quickly is spurring many to take action as promptly as possible, due to fears of prices becoming insurmountable later in the year.

The report published by Halifax indicated a 1.4% increase in average house prices between March and April, taking the average price of a UK home to a new record high of £258,204.

Ongoing house price growth is predicted

When Chancellor Rishi Sunak announced the initial stamp duty holiday that was scheduled to expire at the end of March, it triggered a major spike in real estate market activity. The same also occurred when the Chancellor confirmed the extension of the stamp duty holiday to September, under a policy that will see some relief for buyers come to an end as early as June.

“The stamp duty holiday continues to add impetus to an extremely active market, magnifying the current shortage of available homes as buyers aim to take advantage of the government scheme,” said Russell Galley, managing director at Halifax.

Experts had predicted that the initial impact of the stamp duty holiday would gradually fade over the course of Q2, but the scarceness of affordable inventory coupled with rock-bottom interest rates is continuing to fuel the real estate market across the UK.

Speaking on behalf of James Pendleton Estate Agents, analyst Lucy Pendleton said that there were no immediate indications of a slowdown on the horizon.

“This market isn’t standing still for a second,” she commented.

“The feeding frenzy for property was already feeling pretty ferocious, but then along comes another big leap in the annual rate of [house price] growth.”

She said the current state of the market means timing is crucial for buyers, and not wasting time is essential.

“In a blazing hot seller’s market like this, most buyers don’t even compare prices locally to make their offer; they work out what they can afford, and they go for it.”

Her sentiments were echoed by the managing director at estate agent Fine & Country, Nicky Stevenson, who warned that the UK property market in its current state is not for the faint-hearted.

“Buyers need to be incredibly determined to succeed in a market like this,” she said.

“This won’t be the last record high we’ll see this year by a long stretch.”

London Homeowners Sue Surveyor for Failing to Spot Knotweed Infestation

A property owner in London was recently awarded tens of thousands of pounds in compensation after filing a case against a chartered surveyor who failed to detect the presence of Japanese knotweed in his garden.

Not only did the homeowner sue their surveyor for the costs of eliminating the knotweed from their property, but also for subsequently improving their garden and for the inconvenience and disruption they endured.

The ruling, which is likely to send shockwaves throughout the UK’s chartered surveyor community, was reached when evidence was presented that the property owner was not alerted to the presence of Japanese Knotweed when they purchased their ground-floor flat in 2014. The invasive plant was apparently not picked up on by the chartered surveyor, though it was spotted a year later by the complainant’s gardener.

A more detailed inspection conducted by specialist knotweed removal company Environut found that the plant was present in at least three places in the garden and had clearly been there for three or more years. The homeowner had to pay the bill to have the knotweed removed, which in total cost him more than £10,000.

A prolific and problematic plant

Japanese Knotweed has the potential to wreak havoc on all types of homes and gardens, with properties in London in particular known for being at risk to the invasive plant species. When new shoots of Japanese Knotweed are spotted, they can quickly grow to heights of more than 200cm and create an extensive root system underground.

This can lead to extensive damage to patios, pathways, fences, and drives. It can even find its way into the foundations and wall cavities of homes, putting the structural integrity of the property at risk.

When Japanese knotweed was detected at the site of the London Olympic Games, it ended up costing more than £70 million to fully remove it.

For homeowners affected by Japanese knotweed, the risk goes far beyond the potential for extensive structural damage. If the knotweed subsequently escapes the property and poses a threat to any surrounding gardens or homes, those affected can take legal action to recoup the costs of removing it and repairing the damage caused.

The importance of declaring and dealing with knotweed

Declaring the presence of Knotweed on your property can have a negative impact on your home’s market value but is nonetheless essential to do at the earliest possible stage. The earlier problems with Knotweed are addressed, the higher the likelihood of successfully removing every trace of it from your property.

“Even when treated, there’s still a risk; valuers will say there is a residual diminution of the property of two to five percent,” commented Nic Seal from Environut.

He went on to say that the average cost for removing Knotweed from a property in London is around £2,500 for treatment with herbicide, or anything from £5,000 to £10,000 to dig it out in its entirety.

Meanwhile, RHS chief horticultural adviser Guy Barter commented on the possibility of digging it out without hiring a contractor if you are not planning to move home anytime soon.

“It’s evil stuff. It’s a lot of work and not feasible if there’s a vast infestation, but you can dig it out with a spade,” he said. “Because it’s classified as ‘controlled waste’, you can’t let any plant material leave the garden. So stack it up to dry on plastic or concrete, and then burn it. Or put it in rubble bags and leave it to die for a few years, to be sure.”

Charity Warns of Potential Homelessness Crisis as Eviction Ban Deadline Looms

Thousands of private tenants across the UK have fallen into arrears due to the COVID-19 pandemic. Many people now face the risk of homelessness when the ban on evictions comes to an end.

New figures published by Citizens Advice indicate that in January, at least 500,000 private tenants fell behind on their rent payments, with the average debt level per household having reached £730. For almost 60% of these tenants, this was the first time they had ever fallen into arrears and had done so through no direct fault of their own.

According to the debt charity StepChange, there could be up to 150,000 private tenants across the country who now face the prospect of eviction. Their research suggests that up to £370 million in rent arrears have amassed during the COVID-19 crisis, resulting in insurmountable debt for many of those affected.

Zero-hours contracts, job losses, and general financial turbulence have resulted in thousands being unable to pay their rent, having never before missed a single payment.

Evictions ban coming to an end

While the government’s prohibition of private tenant evictions has so far been extended a number of times, the current deadline of May 31 has not yet been altered. This means that any landlords who choose to evict their tenants for failure to pay their rent (even due to COVID-19-related financial issues) will once again be able to do so legally by the end of the month.

Speaking on behalf of StepChange, Richard Lane warned of a potential eviction and homelessness crisis on the immediate horizon.

“Last year, the housing secretary said no one should lose their home because of the pandemic, but this is a real prospect for hundreds of thousands of people, more than half of whom were never in arrears before,” he said.

“With the expiry of the eviction suspension just weeks away, now is the time to find decisive solutions or face a crisis of housing insecurity, problem debt, homelessness, and eviction.”

Critics continue to accuse the government of failing to take sufficient action to avoid a crisis that has been looming for some time.

“If the government doesn’t act, the system will collapse under the weight of a growing eviction crisis after the final bailiff ban lifts,” warned Polly Neate, chief executive of housing charity Shelter.

“The government’s ambition to end homelessness will be totally undermined if more people lose their homes in the year ahead. It must step in to help renters clear their COVID-19 rent debts before it’s too late.”

Meanwhile, a statement from the Ministry of Housing, Communities, and Local Government claimed that more than £140 million has been allocated to local councils to help tackle the issue.

“We’ve put people at the heart of our decision-making, with an unprecedented £352 billion package keeping millions in work and temporarily bolstering the welfare safety net for those most in need,” said the representative.

“Robust protections are still in place for renters, including longer notice periods and banning bailiff enforcement of evictions for all but the most serious cases until May 31. Councils can also provide support through the discretionary housing scheme.”

“We are considering the best way to move on from these emergency measures and will set out further details in due course.”

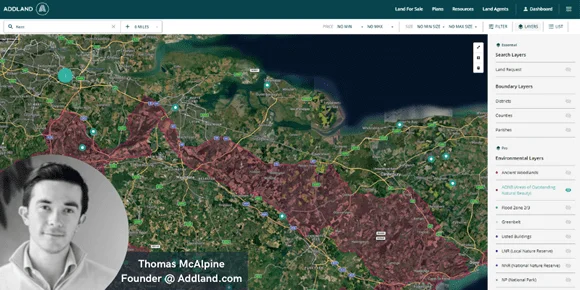

Thomas McAlpine Launches New Platform for Buying and Selling Land

One of the UK’s most innovative and experienced construction, land, and finance veterans has launched a dynamic new online platform for private and commercial land transactions. AddLand.com has the potential to revolutionise the process of finding, researching, buying, and selling land by simplifying all aspects of pinpointing high-potential investment opportunities across the UK.

According to Thomas McAlpine, founder of AddLand.com, his company’s new platform is designed to help users quickly and confidently evaluate the potential of land purchase opportunities. AddLand.com extracts data in real-time from the Ordnance Survey, the Land Registry, and government sites, providing users with a cross-section snapshot of everything they need to know about the land listed for sale.

AddLand.com is designed to be simple enough for casual buyers and first-time housebuilders to find their perfect plots, though sophisticated enough for developers, commercial housebuilders, and land agents to locate viable sites for major development projects.

The platform has already attracted more than 50 of the UK’s biggest property firms, including Savills, Bidwell’s, and Land & New Homes Network.

A new-generation platform for buying and selling land

Commenting on the launch of the new platform, Thomas McAlpine spoke of Add Land’s potential to become the primary dashboard for all types of private and commercial land sales.

“We’re building a generational business with an emphasis on customer satisfaction,” he said.

“Our platform offers a single destination that brings land to life: an aggregation of existing industry subscriptions, an entire end-to-end back-office service, and all the research tools needed to undertake complete due diligence.”

“Digitalizing the whole process this way means we can create both time and financial efficiencies for our customers, making it easier to find, research, buy, or sell land.”

He also confirmed that there will be two subscription options available for those using the platform. The Add Land Essential package will be available free of charge, enabling users to research opportunities for land investments while receiving off-market land alerts, arranging inspections, exchanging messages with land agents, and submitting offers.

The paid Add Land Pro subscription targets more advanced commercial customers, providing access to a wealth of important information, including terrain levels, boundary details, ancient woodland, public rights of way, flood zones, and other environmental considerations.

Enhanced exposure for sellers

Along with simplifying the purchase process for buyers, AddLand.com also promises enhanced exposure for sellers listing their land for sale on the platform. Sellers will likewise benefit from the ability to manage all aspects of the sale process from a simple centralised dashboard as part of the paid Add Land Agent subscription package.

A selection of the paid subscription packages at AddLand.com is being offered free of charge until September this year, providing sellers and buyers with the opportunity to see what’s on offer before committing to a subscription.

“The feedback we have had so far has been hugely positive,” commented Thomas.

“We want to solve a fundamental issue for land agents, land buyers, and other land professionals.”

“I’m looking forward to welcoming more and more agents and land professionals in the coming months to Addison.”

Please visit AddLand.com for more information.

March Records Strongest Real Estate Market Performance Since 2005

Evidence suggests that the UK government’s efforts to stimulate the real estate market are paying off, with the latest figures indicating a surge of activity last month. Spurred at least partially by the extension of the stamp duty holiday, data from HM Revenue and Customs (HMRC) indicates that the highest volume of property transactions since 2005 took place in March.

This impressive and largely unexpected 16-year high suggests that the real estate market has not been affected by the COVID-19 crisis nearly as significantly as anticipated. While there have been major shifts in preferences and areas of interest across the UK, the number of people intent on moving is as high as ever.

The same can also be said for average UK house prices, which for the month of March were up approximately 8.6% on the year before.

A buoyant and boomy spring property market

According to the non-seasonally adjusted figures released by HMRC, exactly 180,690 UK home sales were completed last month. This represents an impressive 50% increase from February and more than twice the number of homes sold in March 2020.

Market watchers had anticipated a significant slowdown in activity during February as the public waited for news on a potential extension to the temporary stamp duty holiday. When the chancellor announced in the Budget on March 4 that stamp duty relief would be extended throughout the summer for most home purchases in England, Wales, and Northern Ireland, a wave of pent-up demand was subsequently released on the market.

In addition, the government also introduced an initiative to encourage high-street lenders to reintroduce 95% LTV mortgages, enabling buyers to qualify for mortgages with a deposit of just 5%. This subsequently proved instrumental in motivating many first-time buyers to take action, who had previously been priced out of the market with typical deposit requirements of 10% to 20%.

A temporary surge or sustainable growth?

Speaking on behalf of property lender MT Finance, commercial director Gareth Lewis questioned whether the market’s current strong performance could be maintained.

“What will be interesting to see is whether this growth is sustainable or simply a reaction to the stamp duty holiday. The next three months will give us a better indication of this,” he said.

“As much as this latest lockdown in particular has been hard, it is encouraging that people have not hunkered down and retreated but carried on with their plans to move.”

While movers and first-time buyers are being encouraged by the government to take action, concerns grow over rapidly escalating property prices in key regions across the country. Annual house price growth recently hit a six-year high, fuelled by the major spike in demand prompted by the government’s stimulus efforts.

According to the Office for National Statistics (ONS), the average asking price for a home in England was up 8.7% year-on-year in February to reach a new high of £268,000.