News

Is Now the Right Time to Consider Equity Release?

The UK’s real estate market has bounced back from its COVID-19 crash at a pace none could have predicted. Fuelled by the temporary stamp duty holiday and the collective desire of millions to upgrade to more spacious rural properties, average house prices recently hit a record high of £238,831.

As a result, many people are finding themselves living in homes that are worth considerably more than at the time they purchased them. Consequently, equity release is becoming an increasingly attractive option among homeowners within the 55+ age bracket.

According to the latest figures from the Equity Release Council, total equity release activity during Q1 this year was up 7% from the same period in 2020. Collectively, homeowners released equity totalling £1.4 billion during the first three months of the year. But does this mean that now is the right time to release equity?

The impact of rising house prices

Eligibility for equity release is based on two things:

- The market value of your home

- How much of your mortgage have you repaid?

Consequently, homeowners with properties that have increased significantly in value could find themselves able to borrow more than would have previously been possible. This could therefore open the door to a wide variety of cost-effective borrowing options, which could be used for anything from home improvements to taking the holiday of a lifetime.

Is now a good time to consider an equity release?

Understandably, the option of releasing equity at an affordable price is an attractive option for many homeowners who lack extensive reserves of on-hand cash. But does the current economic climate make now the right time to consider equity release?

The answer depends entirely on the financial circumstances and long-term outlook of the applicant in question. The fact that average house prices are skyrocketing has no direct bearing on the affordability or otherwise of products like these for the average homeowner.

If you are in a comfortable financial position and can genuinely afford an equity release, then yes, now could be a great time to take action. At the same time, anyone considering equity release also needs to factor in the potential for property values to decrease over the coming years and decades.

Understanding the options available

Reaching a decision without the input of an experienced broker is inadvisable, as there may be significantly better deals on the market than those available from high-street banks.

Whether you are ready to go ahead with an equity release application or simply want to discuss your suitability in more detail, we can help. UK Property Finance offers 100% independent and obligation-free advice on all aspects of equity release, along with a full market comparison service to ensure our clients get the best possible deal.

Simple Steps to Reduce Debt, Starting Today

May brings Debt Awareness Week, during which struggling debtors across the UK are encouraged to take proactive steps to improve their financial circumstances.

According to Step Change, the economic effects of the pandemic are likely to be felt by millions of households for many years to come.

“This Debt Awareness Week, we are focusing on breaking down the stigma that surrounds debt, opening up the conversation, and encouraging people to take #TheFirstStep towards resolving their money worries,” commented Richard Lane, director of External Affairs at Step Change.

“With the week also marking a year since lockdown began in England and Wales and 2.5 million people facing a financial crisis due to the impacts of the coronavirus, it’s important that households across the country know where to get help. You are not alone.”

The charity also outlined a series of simple yet effective steps for reducing debt and restoring financial control, including the following proactive measures:

- eliminate unnecessary outgoings

The key to bringing debt under control lies in first eliminating as many unnecessary and avoidable outgoings as possible. This is where it can be useful to create a list of all monthly expenses and separate them into two categories: needs and wants. After which, anything within the latter that does not qualify as essential can either be minimised or halted entirely.

- Transfer credit card debt

One of the best ways to minimise credit card debt is to transfer the outstanding balances of one or more existing credit cards to a new card with an introductory 0% interest rate. Often valid for a year or so, this 0% period provides plenty of opportunity to gradually pay off at least some credit card debt without incurring any interest in the meantime.

- Consolidate debts with an affordable loan

Specialist-consolidation loans often leave a negative mark on a person’s credit report. With interest rates hovering at all-time lows, an affordable personal loan could be used right now for exactly the same purposes without the risk of credit score damage. Unsecured loans from major high-street lenders are currently hovering around the 3.5% APR mark, which could add up to significant savings if you are currently repaying debts with much higher rates of interest.

- Clear smaller debts where possible

It can also be useful to make the effort to clear as many smaller debts as possible, eliminating interest rates and borrowing costs in the process. An affordable overdraft can still constitute an unnecessary expense—a debt that should be cleared if it is possible to do so.

- Speak to your creditors

Last but not least, anyone who is having genuine difficulties keeping up with their outgoings should consult with their creditors at the earliest possible stage. Some may be willing to offer a temporary payment break at no extra charge while you get your finances in order. Others may be happy to negotiate a reduced monthly payment; it may also be worth consulting with an independent broker before applying for any type of consolidation loan in order to ensure you get the best possible deal.

More Than 110 5% Deposit Mortgages Back on the UK Market

Having been excluded from the market almost in its entirety last year, borrowers seeking affordable 5% deposit mortgages are once again being welcomed by a string of UK lenders. Motivated by a temporary government-backed initiative, major banks including Lloyds, Santander, Barclays, HSBC, and NatWest have reintroduced 95% LTV mortgages for the first time since the start of the COVID-19 crisis.

According to the latest figures from Moneyfacts, general mortgage availability is now at around 75% of its pre-pandemic level, with interest rates dipping as low as 1.27% for borrowers able to provide a larger down payment.

For prospective homebuyers interested in 95% LTV mortgages, there are now more than 110 options available from UK lenders. This represents an increase of around 300% from last month when just 34 mortgage products with 5% deposits were available.

The reintroduction of the 95% LTV mortgage was spurred by a mortgage guarantee scheme, wherein the government has agreed to underwrite 5% deposit loans for the purchase of properties up to a maximum value of £600,000. The initiative is one of many outlined over recent months to assist first-time buyers, who in many instances would be unable to save the usual 10% or 20% down payment required for a mortgage.

Strict qualification criteria

While the availability of 5% deposit mortgages will come as welcome news to many first-time buyers, experts are warning of increasingly strict qualification criteria for prospective applicants.

Along with limited availability for borrowers interested in building their own homes from scratch, borrowers will be expected to have an exceptionally strong credit history to qualify for a 95% LTV mortgage.

Speaking on behalf of Moneyfacts, finance expert Eleanor Williams highlighted the skyrocketing average property prices in the UK as another issue standing in the way of first-time buyers.

‘Higher LTV products returning and rates reducing could not come at a better time as house prices continue to rocket upwards, but housing supply remains an obstacle for would-be buyers.

Average interest rates remain competitive

For those able to qualify for a mortgage, average interest rates are still hovering close to all-time lows. Across all loan types, the current five-year fixed mortgage rate is sitting at around 2.7%, whereas two-year fixed-rate loans are being offered at an average of 2.57%.

The average APR on a 95% LTV mortgage will typically be significantly higher than on a loan with a larger down payment, but experts remain optimistic about the trajectory of the real estate market in general.

‘The sense of optimism in the mortgage sector continues, with product choice continuing its climb back towards pre-pandemic levels,’ added Williams.

‘After seven months of consecutive increases and 3,927 products now on offer, this represents a 53 per cent rise year-on-year and is the highest this total has been since March 2020 (5,222),’

‘Borrowers considering a shorter-term fixed deal may be pleasantly surprised to see that the average overall two-year fixed rate for all loan-to-value ratios reduced for the first time in nine months, dropping by 0.01 per cent to 2.57 per cent,’

‘However, the equivalent five-year fixed rate made a small rise of 0.02 per cent to 2.79 per cent, which may tie into the resurgence of higher LTV products, which traditionally carry higher rates,’

‘It is important to remember that in general, we remain in a relatively low-interest rate environment, with rate reductions evident across many product brackets over the last month and some extremely competitive products on the market for eligible borrowers.’

Halifax Reports a New Record-High Average UK House Price of £258,204

New figures from Halifax suggest that the clamour to claim stamp duty relief before the September deadline shows no sign of abating. As a result, a major spike in demand for desirable properties in key regions has resulted in a huge 8.2% average house price increase within the past 12 months.

This means that the average price of a home in the UK is now £20,000 higher than it was at the same time last year, the fastest rate of growth recorded in five years.

Market watchers have since commented that the momentum is being driven by widespread fear of missing out and a collective desire among movers and first-time buyers to capitalise on the temporary stamp duty holiday.

In addition, the fact that average house prices are climbing so quickly is spurring many to take action as promptly as possible, due to fears of prices becoming insurmountable later in the year.

The report published by Halifax indicated a 1.4% increase in average house prices between March and April, taking the average price of a UK home to a new record high of £258,204.

Ongoing house price growth is predicted

When Chancellor Rishi Sunak announced the initial stamp duty holiday that was scheduled to expire at the end of March, it triggered a major spike in real estate market activity. The same also occurred when the Chancellor confirmed the extension of the stamp duty holiday to September, under a policy that will see some relief for buyers come to an end as early as June.

“The stamp duty holiday continues to add impetus to an extremely active market, magnifying the current shortage of available homes as buyers aim to take advantage of the government scheme,” said Russell Galley, managing director at Halifax.

Experts had predicted that the initial impact of the stamp duty holiday would gradually fade over the course of Q2, but the scarceness of affordable inventory coupled with rock-bottom interest rates is continuing to fuel the real estate market across the UK.

Speaking on behalf of James Pendleton Estate Agents, analyst Lucy Pendleton said that there were no immediate indications of a slowdown on the horizon.

“This market isn’t standing still for a second,” she commented.

“The feeding frenzy for property was already feeling pretty ferocious, but then along comes another big leap in the annual rate of [house price] growth.”

She said the current state of the market means timing is crucial for buyers, and not wasting time is essential.

“In a blazing hot seller’s market like this, most buyers don’t even compare prices locally to make their offer; they work out what they can afford, and they go for it.”

Her sentiments were echoed by the managing director at estate agent Fine & Country, Nicky Stevenson, who warned that the UK property market in its current state is not for the faint-hearted.

“Buyers need to be incredibly determined to succeed in a market like this,” she said.

“This won’t be the last record high we’ll see this year by a long stretch.”

London Homeowners Sue Surveyor for Failing to Spot Knotweed Infestation

A property owner in London was recently awarded tens of thousands of pounds in compensation after filing a case against a chartered surveyor who failed to detect the presence of Japanese knotweed in his garden.

Not only did the homeowner sue their surveyor for the costs of eliminating the knotweed from their property, but also for subsequently improving their garden and for the inconvenience and disruption they endured.

The ruling, which is likely to send shockwaves throughout the UK’s chartered surveyor community, was reached when evidence was presented that the property owner was not alerted to the presence of Japanese Knotweed when they purchased their ground-floor flat in 2014. The invasive plant was apparently not picked up on by the chartered surveyor, though it was spotted a year later by the complainant’s gardener.

A more detailed inspection conducted by specialist knotweed removal company Environut found that the plant was present in at least three places in the garden and had clearly been there for three or more years. The homeowner had to pay the bill to have the knotweed removed, which in total cost him more than £10,000.

A prolific and problematic plant

Japanese Knotweed has the potential to wreak havoc on all types of homes and gardens, with properties in London in particular known for being at risk to the invasive plant species. When new shoots of Japanese Knotweed are spotted, they can quickly grow to heights of more than 200cm and create an extensive root system underground.

This can lead to extensive damage to patios, pathways, fences, and drives. It can even find its way into the foundations and wall cavities of homes, putting the structural integrity of the property at risk.

When Japanese knotweed was detected at the site of the London Olympic Games, it ended up costing more than £70 million to fully remove it.

For homeowners affected by Japanese knotweed, the risk goes far beyond the potential for extensive structural damage. If the knotweed subsequently escapes the property and poses a threat to any surrounding gardens or homes, those affected can take legal action to recoup the costs of removing it and repairing the damage caused.

The importance of declaring and dealing with knotweed

Declaring the presence of Knotweed on your property can have a negative impact on your home’s market value but is nonetheless essential to do at the earliest possible stage. The earlier problems with Knotweed are addressed, the higher the likelihood of successfully removing every trace of it from your property.

“Even when treated, there’s still a risk; valuers will say there is a residual diminution of the property of two to five percent,” commented Nic Seal from Environut.

He went on to say that the average cost for removing Knotweed from a property in London is around £2,500 for treatment with herbicide, or anything from £5,000 to £10,000 to dig it out in its entirety.

Meanwhile, RHS chief horticultural adviser Guy Barter commented on the possibility of digging it out without hiring a contractor if you are not planning to move home anytime soon.

“It’s evil stuff. It’s a lot of work and not feasible if there’s a vast infestation, but you can dig it out with a spade,” he said. “Because it’s classified as ‘controlled waste’, you can’t let any plant material leave the garden. So stack it up to dry on plastic or concrete, and then burn it. Or put it in rubble bags and leave it to die for a few years, to be sure.”

Bank of England: Mortgage Borrowing Hit an All-Time High in March

New figures published by the Bank of England suggest mortgage borrowing hit an all-time high in March this year. Official data shows that property owners in the UK borrowed around £11.8 billion more on mortgages than they repaid in March, the highest monthly net borrowing total since records began.

Analysts have since commented on the government’s temporary stamp duty holiday as the primary catalyst for the spike in borrowing, coupled with rock-bottom interest rates and the availability of competitive deals.

Borrowers across the country raced to beat the original March 31 stamp duty holiday deadline, which was subsequently extended to September 30. A major spike in borrowing and property purchase interest has resulted in a market described as “on the boil” by Nationwide, which recently published figures suggesting a new average property price in the UK of £238,831, an increase of almost £16,000 since the same time last year.

In total, gross mortgage borrowing for March hit £35.6 billion, fuelled by a wave of last-minute activity as buyers desperately sought to take advantage of the temporary stamp duty discount.

The stamp duty suspension scheme is an undeniable success.

This mad March mortgage data highlights the frenzied rush of people to buy in the second half of last year and save thousands of pounds on stamp duty.

“But the celebrations surrounding the stamp duty holiday may soon ring hollow if the market cools off and people find their savings have been wiped out by the premium they have paid for their property.

While an inevitable slowdown is predicted for later in the year, analysts expect the next few months to bring further house price growth in most key areas of the country. First-time buyers in particular are likely to be motivated by the reintroduction of the 95% LTV mortgage, enabling properties to be purchased with a down payment of just 5%.

Having largely disappeared from the market last year, the return of the 5% mortgage was spurred by the introduction of a new government guarantee scheme for lenders taking part in the initiative. First-time buyers and movers will both be able to qualify under the initiative, which is available for mortgages up to a maximum value of £600,000. However, second homes and buy-to-let properties are excluded from the scheme.

Meanwhile, Bank of England data suggests that consumer saving was particularly strong last month, with approximately £16.2 billion more being deposited in accounts than withdrawn during March. A net consumer credit repayment of £535 million was also recorded.

Charity Warns of Potential Homelessness Crisis as Eviction Ban Deadline Looms

Thousands of private tenants across the UK have fallen into arrears due to the COVID-19 pandemic. Many people now face the risk of homelessness when the ban on evictions comes to an end.

New figures published by Citizens Advice indicate that in January, at least 500,000 private tenants fell behind on their rent payments, with the average debt level per household having reached £730. For almost 60% of these tenants, this was the first time they had ever fallen into arrears and had done so through no direct fault of their own.

According to the debt charity StepChange, there could be up to 150,000 private tenants across the country who now face the prospect of eviction. Their research suggests that up to £370 million in rent arrears have amassed during the COVID-19 crisis, resulting in insurmountable debt for many of those affected.

Zero-hours contracts, job losses, and general financial turbulence have resulted in thousands being unable to pay their rent, having never before missed a single payment.

Evictions ban coming to an end

While the government’s prohibition of private tenant evictions has so far been extended a number of times, the current deadline of May 31 has not yet been altered. This means that any landlords who choose to evict their tenants for failure to pay their rent (even due to COVID-19-related financial issues) will once again be able to do so legally by the end of the month.

Speaking on behalf of StepChange, Richard Lane warned of a potential eviction and homelessness crisis on the immediate horizon.

“Last year, the housing secretary said no one should lose their home because of the pandemic, but this is a real prospect for hundreds of thousands of people, more than half of whom were never in arrears before,” he said.

“With the expiry of the eviction suspension just weeks away, now is the time to find decisive solutions or face a crisis of housing insecurity, problem debt, homelessness, and eviction.”

Critics continue to accuse the government of failing to take sufficient action to avoid a crisis that has been looming for some time.

“If the government doesn’t act, the system will collapse under the weight of a growing eviction crisis after the final bailiff ban lifts,” warned Polly Neate, chief executive of housing charity Shelter.

“The government’s ambition to end homelessness will be totally undermined if more people lose their homes in the year ahead. It must step in to help renters clear their COVID-19 rent debts before it’s too late.”

Meanwhile, a statement from the Ministry of Housing, Communities, and Local Government claimed that more than £140 million has been allocated to local councils to help tackle the issue.

“We’ve put people at the heart of our decision-making, with an unprecedented £352 billion package keeping millions in work and temporarily bolstering the welfare safety net for those most in need,” said the representative.

“Robust protections are still in place for renters, including longer notice periods and banning bailiff enforcement of evictions for all but the most serious cases until May 31. Councils can also provide support through the discretionary housing scheme.”

“We are considering the best way to move on from these emergency measures and will set out further details in due course.”

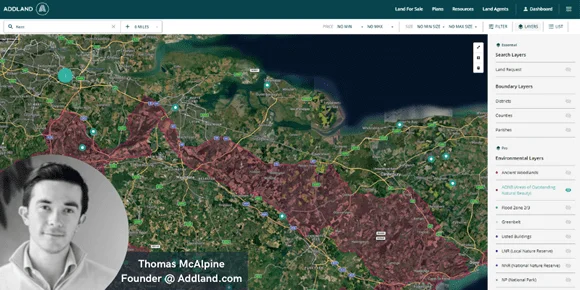

Thomas McAlpine Launches New Platform for Buying and Selling Land

One of the UK’s most innovative and experienced construction, land, and finance veterans has launched a dynamic new online platform for private and commercial land transactions. AddLand.com has the potential to revolutionise the process of finding, researching, buying, and selling land by simplifying all aspects of pinpointing high-potential investment opportunities across the UK.

According to Thomas McAlpine, founder of AddLand.com, his company’s new platform is designed to help users quickly and confidently evaluate the potential of land purchase opportunities. AddLand.com extracts data in real-time from the Ordnance Survey, the Land Registry, and government sites, providing users with a cross-section snapshot of everything they need to know about the land listed for sale.

AddLand.com is designed to be simple enough for casual buyers and first-time housebuilders to find their perfect plots, though sophisticated enough for developers, commercial housebuilders, and land agents to locate viable sites for major development projects.

The platform has already attracted more than 50 of the UK’s biggest property firms, including Savills, Bidwell’s, and Land & New Homes Network.

A new-generation platform for buying and selling land

Commenting on the launch of the new platform, Thomas McAlpine spoke of Add Land’s potential to become the primary dashboard for all types of private and commercial land sales.

“We’re building a generational business with an emphasis on customer satisfaction,” he said.

“Our platform offers a single destination that brings land to life: an aggregation of existing industry subscriptions, an entire end-to-end back-office service, and all the research tools needed to undertake complete due diligence.”

“Digitalizing the whole process this way means we can create both time and financial efficiencies for our customers, making it easier to find, research, buy, or sell land.”

He also confirmed that there will be two subscription options available for those using the platform. The Add Land Essential package will be available free of charge, enabling users to research opportunities for land investments while receiving off-market land alerts, arranging inspections, exchanging messages with land agents, and submitting offers.

The paid Add Land Pro subscription targets more advanced commercial customers, providing access to a wealth of important information, including terrain levels, boundary details, ancient woodland, public rights of way, flood zones, and other environmental considerations.

Enhanced exposure for sellers

Along with simplifying the purchase process for buyers, AddLand.com also promises enhanced exposure for sellers listing their land for sale on the platform. Sellers will likewise benefit from the ability to manage all aspects of the sale process from a simple centralised dashboard as part of the paid Add Land Agent subscription package.

A selection of the paid subscription packages at AddLand.com is being offered free of charge until September this year, providing sellers and buyers with the opportunity to see what’s on offer before committing to a subscription.

“The feedback we have had so far has been hugely positive,” commented Thomas.

“We want to solve a fundamental issue for land agents, land buyers, and other land professionals.”

“I’m looking forward to welcoming more and more agents and land professionals in the coming months to Addison.”

Please visit AddLand.com for more information.