Section 21 Controversy Continues as Government Promises Reform

You would be forgiven for thinking that in this day and age, private landlords would have to have a good reason to evict tenants. For an alarming number of private tenants across the UK, this sadly isn’t the case.

Recently highlighted by a BBC report published following a nationwide survey, landlords across the UK continue to use the controversial ‘section 21’ allowance to evict tenants from their homes.

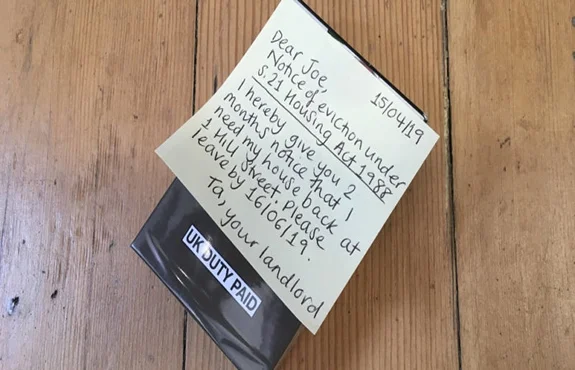

Specifically, Section 21 of the 1988 Housing Act provides private landlords with the right to evict tenants at the end of their current contract, without any specific reason for doing so. They must simply provide two months’ notice of their “intention to evict,” with the tenants being given no say in the matter.

Section 21 exists primarily to provide landlords with the opportunity to evict problematic tenants or those that have fallen behind on their rent payments. Increasingly, landlords are using the Section 21 clause to evict tenants to subsequently sell or let out their properties at a higher price.

Lives in landlords’ hands

The report from the BBC clearly illustrated the effects Section 21 is having on those affected by the controversial clause. One of them was a young family from Weston-Super-Mare, who, after 12 years of tenancy with a private landlord, were handed two months’ notice.

Despite having never missed a rent payment, the Palmers were informed they would have to leave their home.

Having run into multiple hardships over the past few years, the family now fears it will be left homeless. Redundancy and serious illness took a severe toll on the family’s credit rating, resulting in potential private landlords demanding several months’ rent upfront as security. This is money the family simply doesn’t have, putting them at immediate risk of homelessness when their current landlord’s Section 21 notice is enforced.

Like many other families facing similar scenarios, the Palmers expressed their shock at the extent to which so many lives are in the hands of landlords across the UK.

Promised reforms

It’s estimated that last year alone, the so-called “accelerated procedure” for evicting tenants resulted in more than 8,100 repossessions. In all instances, no court hearing was necessary, and the case of the tenants evicted was not heard at a formal legal level.

While some are calling for the rules to be changed to ensure private tenants are given at least six months’ notice prior to no-fault eviction, others believe the system as it exists should be scrapped in its entirety.

Speaking on behalf of the Law Society, Simon Davis directly cited the Section 21 clause as “one of the leading causes of family homelessness in the UK.”

Subsequently, the government has outlined plans to ban no-fault evictions in their entirety in England and Wales. There is currently no specific date as to when the new policy will come into force or the extent of the exclusions that will allow landlords to continue evicting tenants at relatively short notice.