Reducing Borrowing Costs with New Equity Release Rule

Homeowners, who have taken advantage of equity release finance, are now able to make additional partial payments without any charges or penalties in a bid to reduce borrowing costs.

Although this is a feature already offered with some later-life lending products, as of March 28th, the Equity Release Council announced that it will be mandatory for lenders to include this feature with all equity release finance products.

The ability to make extra payments will result in homeowners reducing the impact of compound interest later down the line and decreasing the overall cost of equity release.

Equity Release Finance is a way of releasing the tied-up cash in your home. It allows for borrowing against the equity in your house without being required to make any repayments. The loan is repaid when the borrower either moves into residential care or passes away. To be eligible for equity release, you must be over 55 years old.

This new rule will allow the homeowner to make payments as and when they wish, thereby reducing the amount that the lender will be repaid when the time comes.

The Equity Release Council, which announced the news regarding the new product safeguard on Monday, stated that over the next decade, a total of £39 million in combined savings can be achieved, with further figures predicted to be a whopping £99 million in expected savings over the next twenty years.

Data shows that, in 2021, more than 125K part payments towards equity release plans were made without penalty.

Jim Boyd, CEO of the Equity Release Council, said: “The right to remain in your home for life, with no requirement to make ongoing repayments and no threat of repossession, has been central to the appeal of equity release since 1991 and remains a core pillar of the modern market.

“Our new product standard adds to this by ensuring people have the freedom to reduce their borrowing if circumstances change.

“It enables equity release customers to mitigate the effects of compound interest and reduce their borrowing costs in later life, which we know is often one of their main concerns.”

This latest product standard, released and enforced by the Equity Release Council, sets out the following parameters:

It gives the homeowner the right to live on the property for the rest of their lives; they will also have no obligation to make any payments until they go into full-time care or pass away.

The interest rate is capped or fixed for life. The rate of interest will never change, even when base rates change.

No negative equity guarantee: The debt will never be more than the home is valued at, meaning that relatives will not be burdened with any funds owed to the lender.

The right to move the loan: Providing it meets the criteria, the loan can be moved to a different property.

Jim Boyd added: “Equity release today is a flexible financial planning tool for a range of scenarios, from gifting to family to supporting better living standards over longer lives in retirement.

“Consumers should always use a Council member to explore their options and alternatives to equity release, to benefit from product protections and expert advice, and to decide if it is right for them.”

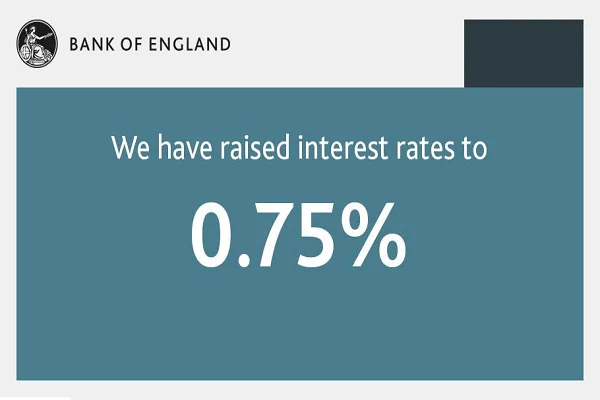

Base Rate Rise to 0.75% Expected from the Bank of England as Inflation Further Escalates

The Bank of England is under increasing pressure to raise interest rates as the Russian attack on Ukraine escalates. Despite the conflict bringing a high level of economic uncertainty to the UK and warnings from the Chancellor of a turbulent future, base rates are expected to rise to 0.75% this week. This, coupled with the expectation that base rates will go as high as 2% by the end of the year, is a real fear in UK households, with the cost of living going up every day.

In February this year, the Bank of England predicted that consumer price inflation would hit its highest level in April at 7.25%, coinciding with the expectation that gas and electricity bills would go up by a whopping 54% when the price cap increased.

These predictions have now been adjusted and are expected to rise to as much as a 9% inflation rate in the coming months. The rise in interest rates is an attempt by the Bank of England to fight the increasing cost of living, making borrowing far more expensive than previously.

With inflation currently at a 30-year high of 5.5% and expected to rise to more than four times the bank’s 2% target, it is imperative that the bank finds a way to get inflation under control.

The invasion of Ukraine by Russia has placed additional pressure on the Bank to increase the base rate.

The nine members of the Monetary Commission are predicted to increase the rate on Thursday of this week (17th March) from the current rate of 0.5% to 0.75% in the battle to gain control over the economy and inflation.

This indicates a third rise in the base rate since December 2021 and will mean increased mortgage costs for millions of UK homeowners.

The invasion of Ukraine has resulted in skyrocketing prices for natural gas, which have risen by an incredible 60% since February, prior to Putin’s troops entering Ukraine.

Experts have stated that the rise in interest rates will not have an immediate effect on inflation in the short term and that the escalating gas and electricity costs will be a struggle for every UK household but will ultimately reduce inflation. Achieving the right balance is the aim of the Bank of England.

Research director at the Resolution Foundation think tank, James Smith, stated, “I think it’s really tough for the bank at the moment to get this right. If they go too slowly, you get an inflation shock. If they go too fast, it chokes off recovery. And then there is a recession risk on top of that.”

The fear among experts is that increasing rates to keep prices down will have a detrimental effect on an already fragile economy. Sanctions levelled at Russia are resulting in massively increased oil prices, which are hitting each and every household with fuel prices going through the roof. All of this disruption is triggering fears of a potential recession.

How to Reduce your Mortgage Repayments and Save Money

As inflation increases and the cost of living rises, many homeowners are looking for ways to reduce spending. One way this can be done is by cutting the cost of their mortgage.

UK households are bracing themselves for the predicted increases in their monthly outgoings due to the increase in inflation and the escalating energy crisis. Alongside this is the rise in interest rates, which will have a serious effect on monthly mortgage repayment amounts.

We calculated that on average, since December 2021, on a standard variable mortgage, people would be paying an additional £656 per year in repayments. So, with tough times ahead, it is wise to consider some options for saving money on your mortgage.

Remortgage your home

This option will suit anyone approaching the end of their existing mortgage deal and should be the first option to consider when trying to reduce monthly repayments. In the current climate, it would be frugal to take advantage of the deals still on offer before the predicted increases in interest rates.

According to research, homeowners can save on average around £3900 per year by switching mortgages and locking in a good deal.

If you are not at the end of your current deal, you may have to pay your mortgage lender an ERC (early repayment charge), but it is useful to know that you can, in fact, switch mortgages six months before the end of your deal without being penalised.

Long-term fixed-rate mortgages

Fixing your monthly repayment amounts can give you a little peace of mind knowing exactly how much you will be paying, irrespective of fluctuating interest rates.

Locking into a good deal on a five-year fixed-interest mortgage could be the perfect solution to bringing a bit of financial stability to homeowners. There are still many great 5-year fixed-interest offers available on the market, particularly for buyers who require a higher loan-to-value (LTV) ratio.

The interest rate on a five-year fixed mortgage is higher than that of a two-year fixed mortgage; however, with the uncertainty of the economy, paying a little more on monthly repayments could pay dividends should the cost of living continue to increase, as expected, in the coming years.

Green mortgages

The concept of a green mortgage is to reward the buyer with an incentive to buy a home that is environmentally friendly. Lenders do this by offering mortgages with lower interest rates, therefore lower monthly repayments for the homeowner.

In order to qualify for a green mortgage, the property must have an EPC (Energy Performance Certificate). Ratings of A or B will give access to the best green mortgage deals, which can offer the biggest discounts in interest rates, cash-back incentives, and additional low-cost borrowing options.

Part and part mortgages

As the name suggests, this type of mortgage is on a partial interest-only and partial repayment basis. Mortgage brokers will tailor a part-and-part mortgage to suit your individual needs and will ensure a clause is included to enable you to make additional overpayments should you wish to.

It is important to consult with an experienced broker when considering a part-time mortgage, as this mortgage product is not suitable for all homeowners.

Overpayments on your mortgage

Monthly overpayments or a single lump-sum payment is a wise move while interest rates are still low. Investing your money in your home during these turbulent economic times could prove to be the best place to put your cash, with many other investment options being very risky.

Typically, most mortgages permit the borrower to overpay by up to 10% per year, and by taking advantage of this, you can make huge savings in the long term. Just an additional £50 per month can save you around £5000 and reduce your mortgage period by 2 years.

Offset mortgage

This type of mortgage links to your savings account and any savings you have in that account will be considered by the lender as mortgage overpayments. You will still have access to the funds in the savings account and be able to withdraw cash, but that will affect the interest rates on the mortgage.

Offset mortgages require that the mortgage and the savings account be with the same provider.

Size of your deposit

It goes without saying that the larger the deposit you have to put down on a property, the better access you have to great deals with low-interest rates. Your monthly payments will be lower, and long term, you will end up paying less for your home.

Bigger Mortgages Could be on the Cards for Buyers as Bank of England Considers Relaxing Affordability Tests

The Bank of England has said it may relax the rules surrounding the affordability of mortgages so that buyers will be able to apply for higher-value homes than they would normally be able to. This will allow people to financially stretch themselves in order to purchase property.

A consultation by the Bank of England has been arranged to discuss the changes that will be made to the affordability tests that lenders are using to assess potential buyers. This will inevitably lead to more borrowers being able to access larger mortgages. This consultation is a direct result of concerns that this will further drive up house inflation.

It is a fact that stringent affordability tests that don’t represent current borrowing conditions have prevented many first-time buyers from taking out a mortgage, which could be considerably cheaper than rental rates.

What changes will be made?

The rules that will be affected will be the affordability test and the loan-to-income limit, both recommendations established in 2014 by the Financial Authority Committee. These rules were created with the intention of preventing buyers from getting themselves into financial difficulty by taking out mortgages that they could not afford.

The rules provide limits on both loan-to-income ratios and affordability, which provides lenders with a “stress” interest rate so that they can assess buyers’ ability to keep up with mortgage repayments.

A loan-to-income ratio is the rate at which banks and lenders will calculate the size of the mortgage they will offer by using the buyers’ annual salary. This rate has been set at 4.5 times the annual salary since 2014.

The affordability test involves the buyer proving that they can afford to keep up with repayments should the interest rates increase by 3% above the standard variable rate of the lender.

Standard variable rate mortgages (SVRs) typically follow on from a fixed rate mortgage when the term has come to an end and are generally more expensive. Many buyers will switch to a new fixed mortgage deal to avoid an SVR mortgage.

Although these rules stopped many from accessing mortgages, only 6% (approximately 30,000 mortgages) of buyers were forced to accept lower-value loans.

The expectation is that the loan-to-income rule will remain as it currently is, but the affordability stress test will be relaxed. This will mean that the repayment amount will be based on predicted market interest rates over the coming 5 years, or an increase of 1% on the current rate, whichever is greater.

Mortgage technical manager at John Charcoal, Nicholas Mendes, commented: “The scrapping of current rules would be welcome by homeowners and brokers alike, as this would be a boost for the market given the ever-increasing property prices”.

‘This will give homeowners, at least in the short term, the ability to borrow more.’

Despite these rule changes, the ever-increasing cost of living could completely nullify the effects of the change, as household bills are on the rise, and lenders will need to factor this in when performing the affordability test.

‘We are expecting to see inflation continue to increase into 2023,’ added Mendes, ‘with multiple base rate rises, lenders could choose not to make any changes because predicting where rates could be in 5 years’ time seems almost impossible.

‘As the costs continue to escalate, we could see lenders exercise caution and start to consider other factors to ensure the mortgage remains affordable.’

Rising rates and escalating inflation have resulted in many lenders, including TSB, Santander, and Barclays, altering their affordability stress tests to reflect the current economic arena.

Mortgage consultant at Private Finance, Chris Sykes, said: ‘We can expect more lenders to take these costs into consideration moving forward, especially after the removal of the energy price cap in April.

‘This means we can expect tighter affordability for some and lower loan amounts available than was previously the case.

‘This could reduce people’s maximum borrowing, which in turn could be a problem for those already in a tight situation.

‘We are already seeing the impact these changes are having on Barclays, with a recent client able to borrow a very significant £100,000 less following the implementation of the changes to their affordability calculator.’

This could present problems, not only for first-time buyers but also for people looking to remortgage their property. It will prevent many owners from being able to remortgage their homes, forcing them to remain on more expensive monthly repayments.

In addition, the increased price of the average home will further contribute to the difficulties first-time buyers are having trying to get a foot on the property ladder.

Buy-to-Let Changes Landlords Need to Know in 2022

Over the next few months, buy-to-let landlords are to be hit by a raft of tax changes. From stamp duty rates to capital gains tax to buy-to-let tax relief alterations, things look set to become even more difficult for BTL landlords running businesses in the UK.

Income Tax Rates 2022

The current personal allowance (the amount you can earn before paying income tax) is up £70 from last year, now standing at £12,570. This is to remain fixed until 2027 at the earliest.

For this tax year, BTL landlords generating income between £12,571 and £50,270 will be taxed at a rate of 20%, those earning above this £50,270 threshold will be subject to 40% taxation, while the £150,000 threshold paves the way for 45% or higher rate taxation.

Capital Gains Tax

One welcome change to BTL legislation is the extension of the time landlords have to report and pay capital gains tax, following the sale of a property.

Reduced significantly from 22 months to just 30 days in April 2020, the grace period has now been doubled to 60 days.

Increases in capital gains tax had been predicted for some time, but are set to remain unchanged for the time being.

Tax Credit

For this tax year, BTL business owners will again be able to claim a tax credit worth 20% on interest payments, rather than deducting mortgage costs from their rental income.

It has now been five years since the government introduced its controversial tax changes for BTL landlords, gradually reducing mortgage tax relief each year until it was wiped out entirely last year.

Companies House data suggests that more BTL landlords set up limited companies when purchasing new rental properties last year than ever before, in order to avoid higher rate personal income taxation by instead paying corporation tax at a fixed rate of 19%.

Buy-to-Let Stamp Duty

All stamp duty incentives for BTL property purchases in England have now ended, which up until October 2021 provided buyers with the opportunity to save (on average) £2,000.

As of now, normal stamp duty rates have resumed for investors in England, as follows:

| Property price | Stamp duty rate | |

| £0 — £125,000 | 3% | |

| £125,001 — £250,000 | 5% | |

| £250,001 — £925,000 | 8% | |

£925,001 —

£1.5 million |

13% | |

| £1.5 million + | 15% |

Stamp duty obligations differ slightly for BTL property purchases in Scotland and Wales.

Other Buy-to-Let Regulation Changes

Along with the alterations to tax obligations outlined above, several further regulatory changes for BTL landlords have been outlined by the government.

Key proposals for the year ahead (part of the Levelling Up White Paper published by the government) include:

- A national landlord register

- the end of Section 21 evictions

- a minimum standard for all rental properties

- more fines and bans for rogue landlords

Legislation is also set to be introduced on the installation of CO2 alarms in BTL properties, along with the requirement for rental homes to meet elevated energy efficiency standards by law.

Build-to-Rent Rivals Buy-to-Let as Demand for Rental Property Increases

The hot topic of conversation among investors and developers at the moment is the exponential growth of the build-to-rent sector over the last few years. With the ever-increasing demand for rental properties, it isn’t surprising that this niche area of the property market has really taken off.

Up until now, the build-to-rent industry has been mainly led by London, but there are many regional towns and cities that are following suit, leading to a prediction by Savills that the size of the sector will double over the next few years.

Build-to-rent developments are giving the buy-to-let market some serious competition as they are tailored to suit the needs of today’s typical renter, often offering facilities that wouldn’t be seen in a traditional BTL property.

These BTR developments tend to be backed by institutional investors; however, there are always opportunities for individuals to invest in these projects.

The BPF (British Property Federation) has been analysing the performance of the build-to-rent market in order to report on its importance in tackling the housing shortage for UK renters.

While the sector has previously been more predominant in London, there is a significant increase in investment into BTR developments in other areas of the UK, particularly in the North. The last twelve months have seen 13,527 new homes currently under construction in regional cities, which is three times the number seen in London.

BPF director of real estate, Ian Fletcher, says: “The build-to-rent sector continues to expand rapidly, and in 2021 we started to see signs that delivery across the regions is beginning to outpace London.

“It is not just about increasing housing provision; it is a major economic driver, helping attract and retain skilled workers and serving as a catalyst for urban regeneration.

“The strong growth of the BTR sector across the regions will support the government’s levelling-up initiative and help revitalise town and city centres.”

The growth of the build-to-let sector can be mainly attributed to the desperate need for affordable rental property, as demand is significantly higher than supply. With more people taking on mortgages later on in life or deciding that they prefer the flexibility that the renting world offers, it can be safely predicted that the market for BTL will continue to grow in strength.

Buy-to-let developments are typically looking at long-term residents when it comes to the facilities that they offer. For example, communal outside spaces, workspaces, gyms, and other conveniences would suit today’s modern living, particularly for people who work from home.

Data released by BPF shows 70,785 buy-to-rent units in the UK, an increase of 26% from the previous year. 141,215 BTR properties are under construction or currently being planned, which is an increase of ten thousand since 2020.

Manchester, Sheffield, Birmingham, and Liverpool have seen a year-on-year rise of 27% in buy-to-let properties under construction. This is an increase of around 26,820 as of the last quarter of 2021.

Jacqui Daly, a director of residential research at Savills, says: “The geographic spread of build-to-rent shows that many more local authorities are beginning to understand the need for new rental stock, and planning consents are rising as a consequence.

“At the same time, BTR is becoming hugely competitive for investors, with a record level of capital deployed in the sector in 2021. If investors are able to find markets and stocks to invest in, we expect delivery in the sector to double within a few years.”

Another vital advantage of the growth of the build-to-let market is the positive impact it can have on the environment, as developments are designed to support the government’s ESG (environmental and social governance) targets.

Robert Sloss, group chief executive and founder of HUB Residential, says: “City living in well-designed buildings can significantly reduce residents’ carbon footprints, so it is encouraging that metropolitan BTR is increasingly in demand across the country. We want to see an intelligent and measurable approach to carbon reduction and ESG.”

Remortgage Instructions Increase by 35% in October as Buyers Prepare for Rates Rise

With the anticipated rise in interest rates looming, more and more homeowners are opting to remortgage their properties, with 67% of people remortgage their homes expecting a significant interest rate rise within the next twelve months.

The end of the stamp duty tax break has, however, done little to decrease interest in the home mover market.

LMC has released figures showing remortgage instructions currently in the pipeline have increased by 13%, while completions rose by 15%, with the total cancellation rate dropping by 0.37%.

The report shows that homeowners who remortgaged in October saved an average of £219 per calendar month, with 23% of borrowers opting to increase the size of their loan.

CEO of LMS, Nick Chadbourne, commented: “Despite the Bank of England’s decision to maintain the base rate at 0.1%, our research shows that two-thirds (67%) of people expect interest rates to rise within the next year. This, paired with the increase in product rates, which came as lenders pre-empted a possible rise, could be part of what fuelled the surge in instructed cases in October, as many borrowers shopped around to lock in the best rate available.

“The number of remortgage completions continues to climb for the second consecutive month due, in part, to the high volume of fixed-rate mortgages that expired at the end of September. It’s a promising sign to see the industry efficiently progressing with high levels of pipeline activity.

“Purchase pipelines remain high, and the ending of the stamp duty holiday failed to dampen demand in the home mover market. This, combined with the high levels of ERC expiries due on December 31st and the continued buzz surrounding interest rates, should contribute to a busy few months. Those in the industry should prepare themselves for this increased activity.”

40-Year Fixed-Rate Mortgages Raise Questions and Concerns

Mortgages with repayment periods that span several decades have traditionally been the preferred option for most borrowers. Being able to spread the costs over an extensive period of time is the only realistic entry point to the housing market for the vast majority of buyers.

The introduction of a new 40-year mortgage product by Kensington Mortgages has understandably caught the eye of an extensive audience of prospective applicants. Particularly given how this particular product is a 40-year fixed-rate deal.

Typically, fixed-rate deals are rarely available beyond the traditional two-year or five-year fixed-rate loan. Many lenders have introduced 10-year fixed-rate products, but a mortgage with a fixed rate for 40 years is practically unheard of.

“A [longer] fixed-for-term mortgage, already very popular in some parts of continental Europe, is likely to become increasingly attractive in a rate-rising environment,” said Mark Arnold, chief executive of Kensington Mortgages.

While the appeal of such a product is clear, many brokers and independent advisors have their doubts. A 40-year fixed-rate term could pave the way for affordable monthly repayments, but there are potential downsides applicants must take into account.

Capitalising on record-low mortgage rates

The UK’s real estate sector has been a hive of activity as of late, as millions aim to take advantage of interest rates at historic lows. Some of the most competitive deals of all have taken the form of two-year and five-year fixed-rate deals, some of which have an initial APR of less than 1%.

But the only reason banks and lenders have been willing to offer such low-interest rates is that they are strictly temporary. After the initial two-, five-, or 10-year period, they can be adjusted as the lender sees fit.

With a 40-year fixed-rate deal, this is not an option. The APR agreed upon at the time the loan is taken out will remain fixed for the life of the mortgage, irrespective of what happens with Bank of England base rates.

This is where those tying themselves into such long-term fixed-rate deals need to exercise caution. Even if the rate agreed on the loan is competitive at first, it could become quite the opposite in years and decades to come.

All terms and conditions attached to the loan will also remain fixed for the entire 40-year period.

The benefits of early repayment

Another concern raised by experts is the potential for longer-term mortgages to discourage home buyers from potentially repaying their mortgages at an early date. Often unaware of the fact that doing so could pave the way for significant savings while ensuring lower costs of living upon reaching retirement,

“The rise of mortgages with ultra-long terms that stretch way past retirement age is worrying. It requires a fundamental rethink of what people will need in retirement and could require a change to the assumptions that underpin current guidance for pension savers on how much they should aim to have in their pot,” said Becky O’Connor, head of pensions and savings at Interactive Investor.

“If you are considering paying a mortgage into retirement, there’s a huge reality check coming: you will need a much bigger pension than most people are currently on track for to finance this additional borrowing.”